QQuestionAnatomy and Physiology

QuestionAnatomy and Physiology

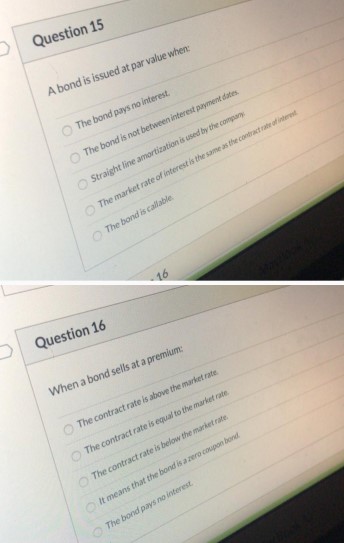

# Question 15

A bond is issued at par value when:

The bond pays no interest.

The bond is not between interest payment dates.

Struight line amortization is used by the company.

The market rate of interest is the same as the contract rate of interest.

The bond is a double.

## Question 16

When a bond sells at a premium:

The contract rate is above the market rate.

The contract rate is equal to the market rate.

The contract rate is below the market rate.

It means that the bond is a zero-impact bond.

The bond pays no interest.

Attachments

6 months agoReport content

Answer

Full Solution Locked

Sign in to view the complete step-by-step solution and unlock all study resources.

Step 1I'll solve these accounting bond valuation problems step by step:

## Question 15: A bond is issued at par value when:

Step 2: Analyze the conditions for a bond to be issued at par value

A bond is issued at par value when: - The market rate of interest is exactly the same as the contract rate of interest

Final Answer

## Question 16: When a bond sells at a premium: Step 1: Understand bond premium pricing A bond sells at a premium when: - The contract (coupon) rate is HIGHER than the current market interest rate Step 2: Explain the pricing mechanism When the bond's stated interest rate (contract rate) is higher than prevailing market rates, investors are willing to pay more than the bond's face value to receive the higher interest payments. These solutions demonstrate the fundamental relationship between market interest rates and bond pricing in financial markets.

Need Help with Homework?

Stuck on a difficult problem? We've got you covered:

- Post your question or upload an image

- Get instant step-by-step solutions

- Learn from our AI and community of students