QQuestionAnatomy and Physiology

QuestionAnatomy and Physiology

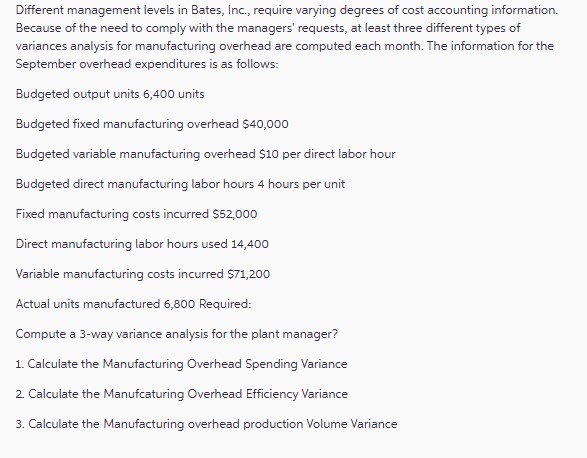

Different management levels in Bates, Inc., require varying degrees of cost accounting information. Because of the need to comply with the managers' requests, at least three different types of variances analysis for manufacturing overhead are computed each month. The information for the September overhead expenditures is as follows:

- Budgeted output units: 6,400 units

- Budgeted fixed manufacturing overhead: $40,000

- Budgeted variable manufacturing overhead: $10 per direct labor hour

- Budgeted direct manufacturing labor hours: 4 hours per unit

- Fixed manufacturing costs incurred: $52,000

- Direct manufacturing labor hours: used: 14,400

- Variable manufacturing costs incurred: $71,200

- Actual units manufactured: 6,800

- Required:

- Compute a 3 -way variance analysis for the plant manager:

1. Calculate the Manufacturing Overhead Spending Variance

2. Calculate the Manufacturing Overhead Efficiency Variance

3. Calculate the Manufacturing overhead production Volume Variance

Attachments

6 months agoReport content

Answer

Full Solution Locked

Sign in to view the complete step-by-step solution and unlock all study resources.

Step 1: Calculate the Manufacturing Overhead Spending Variance

The Manufacturing Overhead Spending Variance (MOSV) compares the actual manufacturing overhead costs incurred to the budgeted manufacturing overhead costs, given the actual level of activity. MOSV = (Actual variable manufacturing overhead + Actual fixed manufacturing overhead) - Budgeted manufacturing overhead Budgeted manufacturing overhead = Budgeted fixed manufacturing overhead + (Budgeted variable manufacturing overhead * Actual direct labor hours)

Step 2.1: Calculate the Budgeted Manufacturing Overhead

Budgeted manufacturing overhead = $40,000 + ($10 * 14,400) = $40,000 + $144,000 = $184,000

Final Answer

1. Manufacturing Overhead Spending Variance: -$60,800 (unfavorable) 2. Manufacturing Overhead Efficiency Variance: $200,800 (favorable) 3. Manufacturing overhead production Volume Variance: $12,750 (unfavorable)

Need Help with Homework?

Stuck on a difficult problem? We've got you covered:

- Post your question or upload an image

- Get instant step-by-step solutions

- Learn from our AI and community of students