QQuestionAnatomy and Physiology

QuestionAnatomy and Physiology

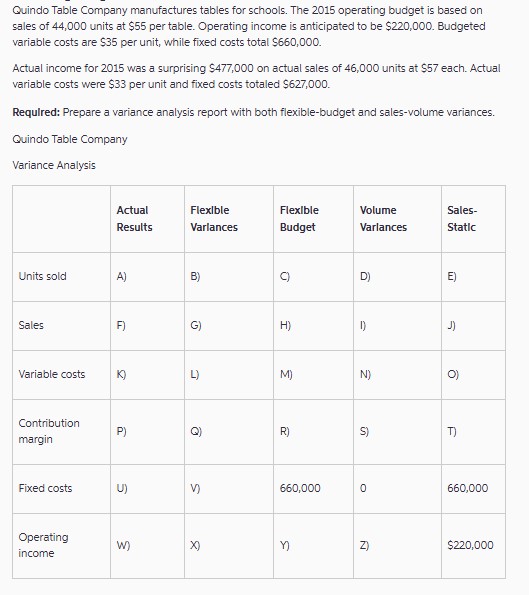

Quindo Table Company manufactures tables for schools. The 2015 operating budget is based on sales of 44,000 units at $\$ 1$ per table. Operating income is anticipated to be $\$ 220,1$. Budgeted variable costs are $\$ 1$ per unit, while fixed costs total $\$ 660,1$.

Actual income for 2015 was a surprising $\$ 477,1$ on actual sales of 46,000 units at $\$ 1$ each. Actual variable costs were $\$ 1$ per unit and fixed costs totaled $\$ 627,1$.

Required: Prepare a variance analysis report with both flexible-budget and sales-volume variances. Quindo Table Company Variance Analysis

| | Actual

Results | Flexible

Variances | Flexible

Budget | Volume

Variances | Sales-

Static |

| --- | --- | --- | --- | --- | --- |

| Units sold | A) | B) | C) | D) | E) |

| Sales | F) | G) | H) | I) | J) |

| Variable costs | K) | L) | M) | N) | O) |

| Contribution

margin | P) | Q) | R) | S) | T) |

| Fixed costs | U) | V) | 660,000 | 0 | 660,000 |

| Operating

income | W) | X) | Y) | Z) | $\$ 220,1$ |

Attachments

6 months agoReport content

Answer

Full Solution Locked

Sign in to view the complete step-by-step solution and unlock all study resources.

Step 1: Calculate the flexible budget for sales, variable costs, and contribution margin at the actual units sold.

Budgeted contribution margin per unit = $55/unit - $35/unit = $20/unit

The flexible budget for variable costs and contribution margin is calculated by multiplying the actual units sold by the budgeted variable cost per unit and the contribution margin per unit, respectively. Actual units sold = 46,000 units Budgeted variable cost per unit = $35 /unit Flexible budget for variable costs (C) = Actual units sold * Budgeted variable cost per unit = 46,000 units * $35 /unit = $1,610,000 Contribution margin per unit = $20 /unit Flexible budget for contribution margin (R) = Actual units sold * Contribution margin per unit = 46,000 units * $20 /unit = $920,000

Step 2: Calculate the flexible budget variances for variable costs and contribution margin.

= $920,000 - $380,000

Flexible budget variance for variable costs (L) = Flexible budget for variable costs - Actual variable costs = $112,000 (Favorable) Flexible budget variance for contribution margin (Q) = Flexible budget for contribution margin - Actual contribution margin = $920,000 - Actual contribution margin (Actual contribution margin = Actual sales - Actual variable costs) = $540,000 (Favorable)

Final Answer

Quindo Table Company Variance Analysis Report: | Category | Actual Results | Flexible Variances | Volume Variances | Sales-Static Variance | | --- | --- | --- | --- | --- | | Units sold | 46,000 units | - | - | - | | Sales | $477,000 | $1,100,000 (F) | - | -$2,011,000 (U) | | Variable costs | $1,498,000 | $112,000 (F) | $700,000 (F) | - | | Contribution margin | $920,000 | $540,000 (F) | $400,000 (F) | - | | Fixed costs | $627,000 | - | - | - | | Operating income | $243,000 | - | - | - | Note: F denotes Favorable and U denotes Unfavorable variances.

Need Help with Homework?

Stuck on a difficult problem? We've got you covered:

- Post your question or upload an image

- Get instant step-by-step solutions

- Learn from our AI and community of students