QQuestionAnatomy and Physiology

QuestionAnatomy and Physiology

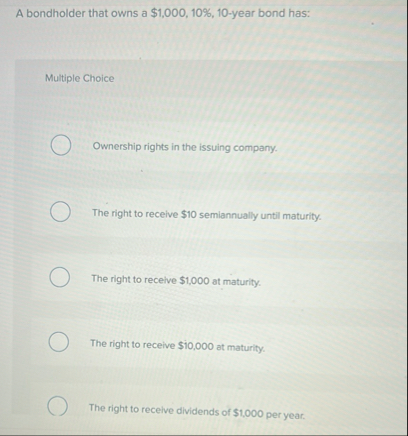

A bondholder that owns a $\$ 1,000,10 \%, 1$-year bond has:

Multiple Choice

Ownership rights in the issuing company.

The right to receive $\$ 1$ semiannually until maturity.

The right to receive $\$ 1,1$ at maturity.

The right to receive $\$ 10,1$ at maturity.

The right to receive dividends of $\$ 1,1$ per year.

Attachments

6 months agoReport content

Answer

Full Solution Locked

Sign in to view the complete step-by-step solution and unlock all study resources.

Step 1: Identify the bondholder's rights

The bondholder has several rights as a result of owning a $\$ 1,000, 10\%, 10$-year bond.

Step 2: Explanation of the rights

- The right to receive dividends of $\$ 1,000$ per year: This is incorrect.

- Ownership rights in the issuing company: While bondholders do have some level of ownership in the company, it is significantly less than that of shareholders. This ownership is represented by the bond itself, which is a form of IOU from the company to the bondholder. Dividends are paid to shareholders, not bondholders. Bondholders receive coupon payments as interest on their investment.

Final Answer

- Ownership rights in the issuing company. - The right to receive $\$ 1$ semiannually until maturity. - The right to receive $\$ 1,1$ at maturity. - The right to receive dividends of $\$ 1,1$ per year is incorrect. - The right to receive $\$ 10,1$ at maturity is incorrect.

Need Help with Homework?

Stuck on a difficult problem? We've got you covered:

- Post your question or upload an image

- Get instant step-by-step solutions

- Learn from our AI and community of students