QQuestionAnatomy and Physiology

QuestionAnatomy and Physiology

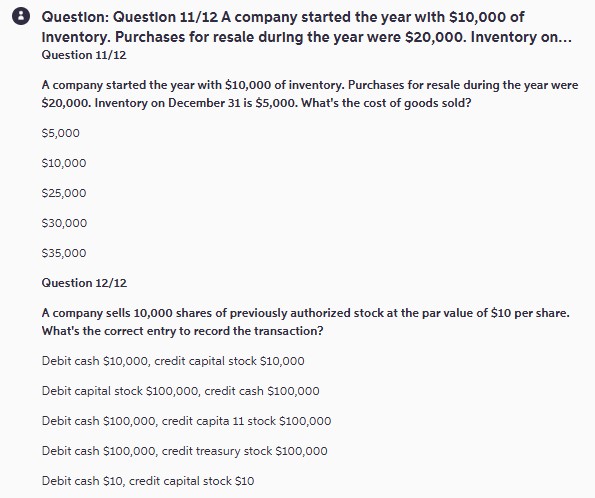

Question: Question 11 / 12 A company started the year with $\$ 10,1$ of Inventory. Purchases for resale during the year were $\$ 20,1$. Inventory on... Question 11 / 12

A company started the year with $\$ 10,1$ of inventory. Purchases for resale during the year were $\$ 20,1$. Inventory on December 31 is $\$ 5,1$. What's the cost of goods sold?

$\$ 5,1$

$\$ 10,1$

$\$ 25,1$

$\$ 30,1$

$\$ 35,1$

Question 12 / 12

A company sells 10,000 shares of previously authorized stock at the par value of $\$ 1$ per share. What's the correct entry to record the transaction?

Debit cash $\$ 10,1$, credit capital stock $\$ 10,1$

Debit capital stock $\$ 100,1$, credit cash $\$ 100,1$

Debit cash $\$ 100,1$, credit capita 11 stock $\$ 100,1$

Debit cash $\$ 100,1$, credit treasury stock $\$ 100,1$

Debit cash $\$ 1$, credit capital stock $\$ 1$

Attachments

6 months agoReport content

Answer

Full Solution Locked

Sign in to view the complete step-by-step solution and unlock all study resources.

Step 1: Calculate the total inventory available at the end of the year.

Total inventory available = $10,000 + $20,000 = $30,000

This is the sum of the starting inventory and purchases made during the year. Total inventory available = Starting inventory + Purchases

Step 2: Calculate the cost of goods sold (COGS) by subtracting the ending inventory from the total inventory available.

COGS = $30,000 - $5,00

COGS = Total inventory available - Ending inventory

Final Answer

COGS = $30,000 - $5,00

Need Help with Homework?

Stuck on a difficult problem? We've got you covered:

- Post your question or upload an image

- Get instant step-by-step solutions

- Learn from our AI and community of students