QQuestionAccounting

QuestionAccounting

calculate the break-even point in units use the formula: Break-Even point (units) = Fixed Costs ÷ (Sales price per unit – Variable costs per unit) or in sales dollars using the formula: Break-Even point (sales dollars) = Fixed Costs ÷ Contribution Margin.

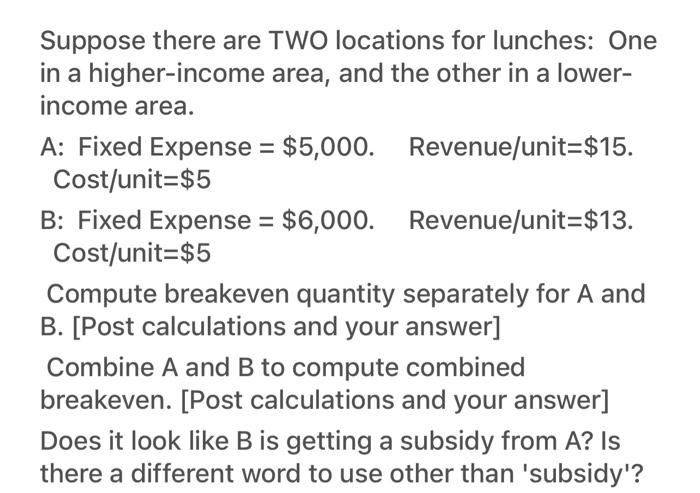

Suppose there are TWO locations for lunches: One in a higher-income area, and the other in a lower-income area.

A: Fixed Expense = \$5,000. Revenue/unit=\$15. Cost/unit=\$5

B: Fixed Expense = \$6,000. Revenue/unit=\$13. Cost/unit=\$5

Compute breakeven quantity separately for A and B. [Post calculations and your answer]

Combine $A$ and $B$ to compute combined breakeven. [Post calculations and your answer]

Does it look like B is getting a subsidy from A? Is there a different word to use other than 'subsidy'?

Attachments

5 months agoReport content

Answer

Full Solution Locked

Sign in to view the complete step-by-step solution and unlock all study resources.

Step 1: Calculate the Break-Even Point (units) for location A using the formula: Break-Even point (units) = Fixed Costs ÷ (Sales price per unit – Variable costs per unit)

\text{Break-Even point (units) for A} = \$5,000 ÷ (\$15 - \$5)

Step 2: Simplify the equation by first performing the subtraction inside the parentheses:

\text{Break-Even point (units) for A} = \$5,000 ÷ \$10

Final Answer

\text{Contribution Margin per unit for B} = \$13 - \$5 = \$8

Need Help with Homework?

Stuck on a difficult problem? We've got you covered:

- Post your question or upload an image

- Get instant step-by-step solutions

- Learn from our AI and community of students