Page 1

Loading page ...

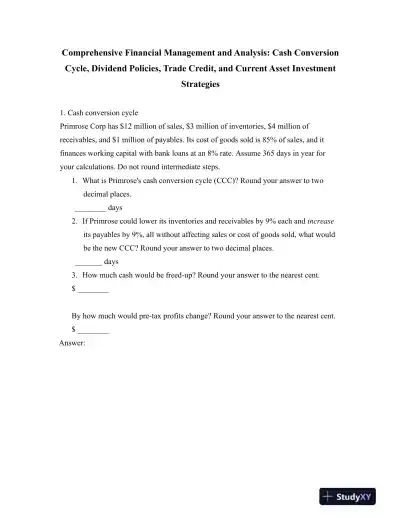

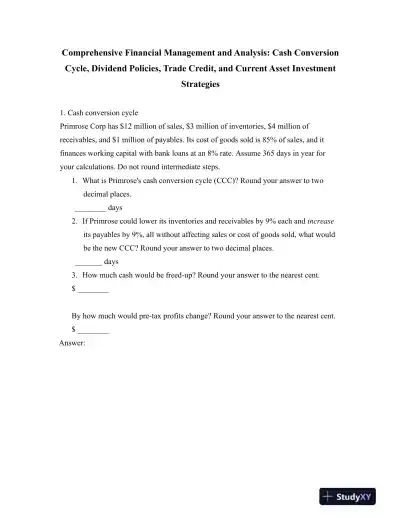

An in-depth study of financial management, focusing on cash conversion cycles, dividend policies, trade credit, and current asset investment strategies.

Loading page ...

This document has 18 pages. Sign in to access the full document!