Page 1

Loading page ...

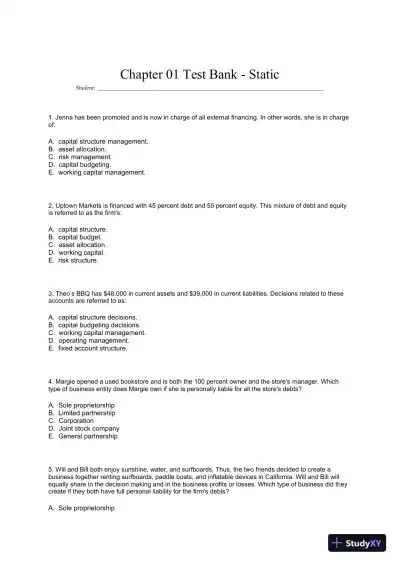

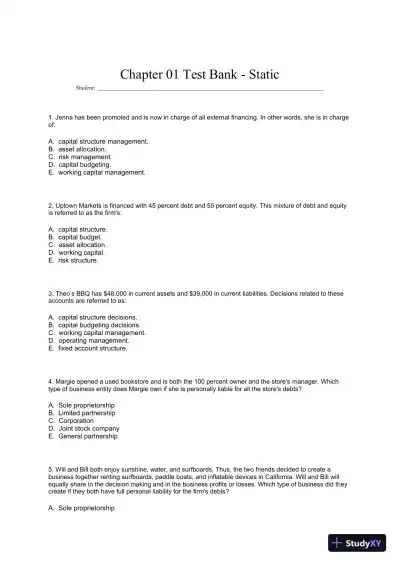

Achieve top scores with Essentials of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate) 9th Edition Test Bank, a well-crafted guide filled with must-know information, examples, and revision techniques.

Loading page ...

This document has 888 pages. Sign in to access the full document!