Page 1

Loading page image...

Page 2

Loading page image...

Page 3

Loading page image...

Page 4

Loading page image...

Page 5

Loading page image...

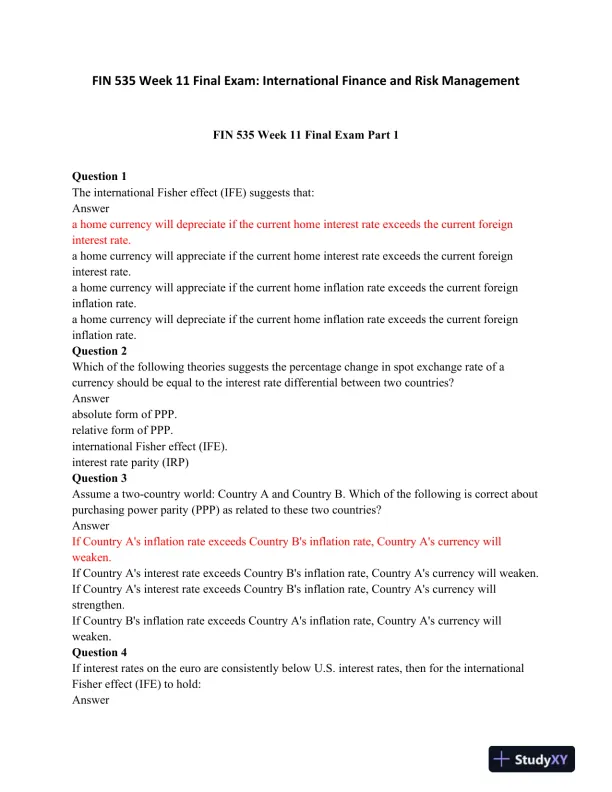

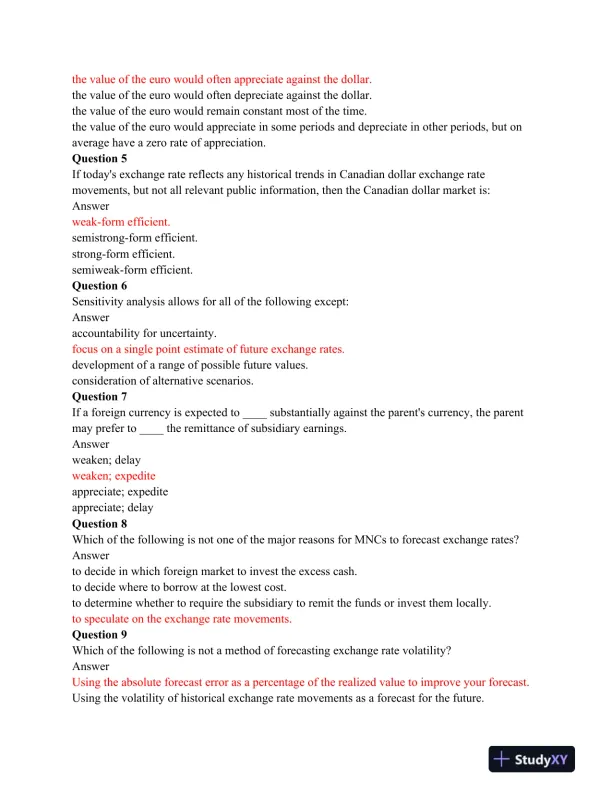

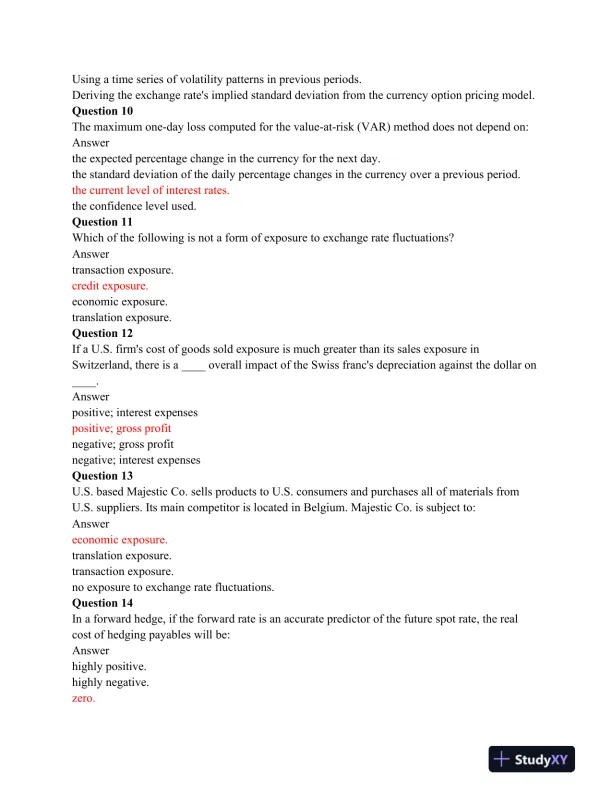

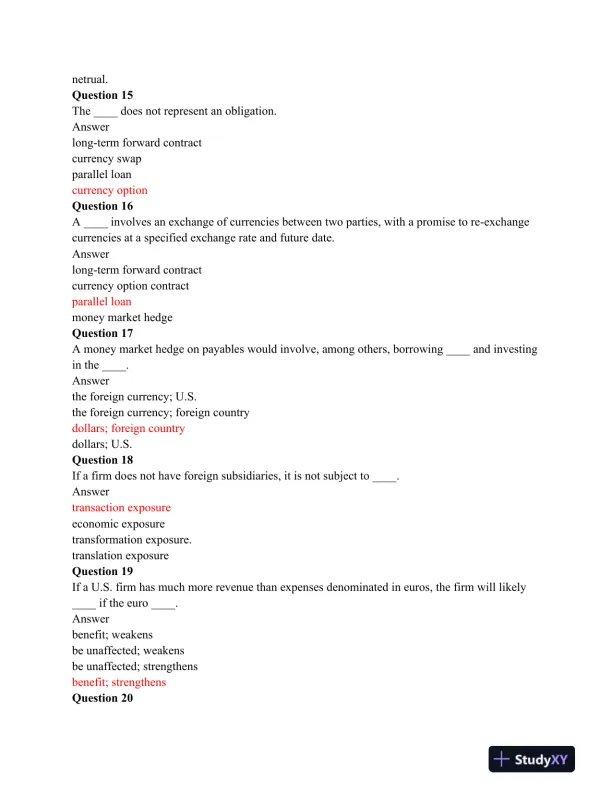

A week 11 final exam focusing on international finance, risk management techniques, and financial strategies in the global market.

Loading page image...

Loading page image...

Loading page image...

Loading page image...

Loading page image...

This document has 15 pages. Sign in to access the full document!