Page 1

Loading page image...

Page 2

Loading page image...

Page 3

Loading page image...

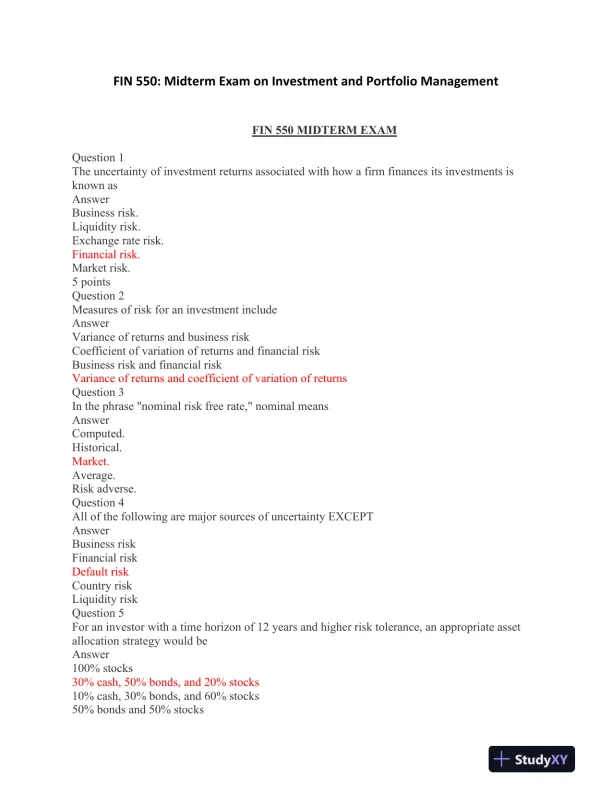

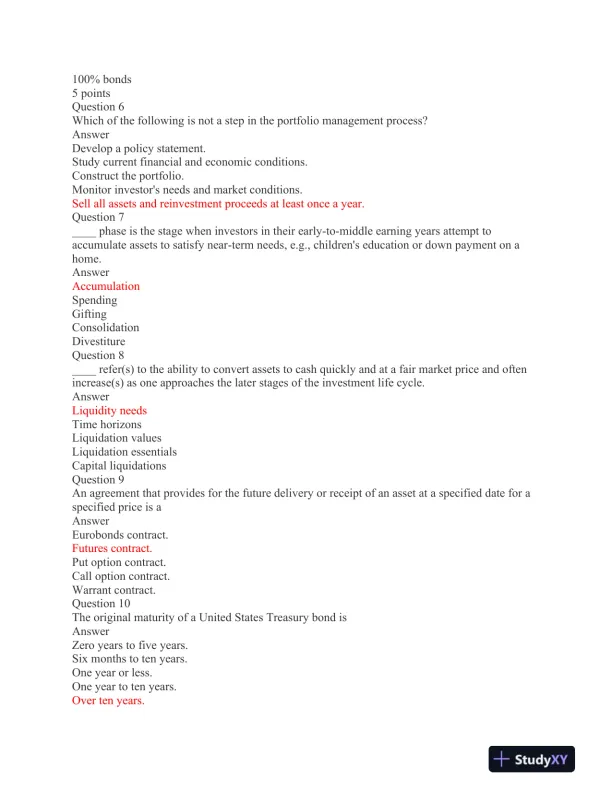

A midterm exam on investment strategies and portfolio management, with a focus on building diversified portfolios and assessing risk.

Loading page image...

Loading page image...

Loading page image...

This document has 8 pages. Sign in to access the full document!