Page 1

Loading page ...

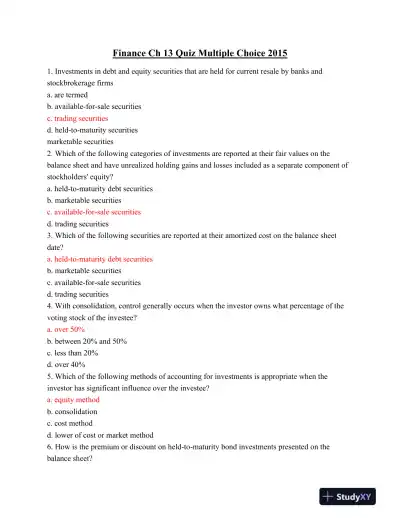

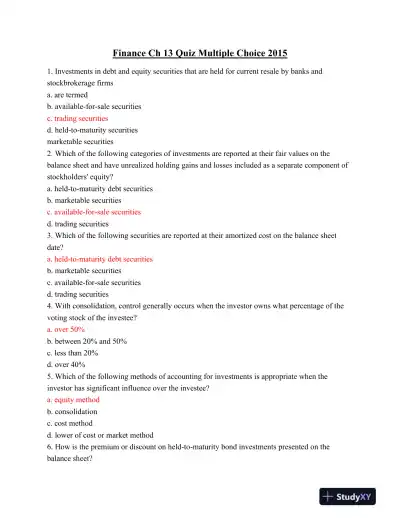

A quiz covering key concepts in investment and securities accounting, including valuation methods, market impact, and financial reporting standards.

Loading page ...

This document has 11 pages. Sign in to access the full document!