Page 1

Loading page ...

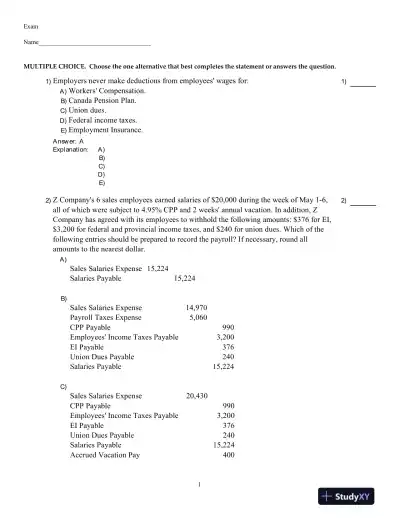

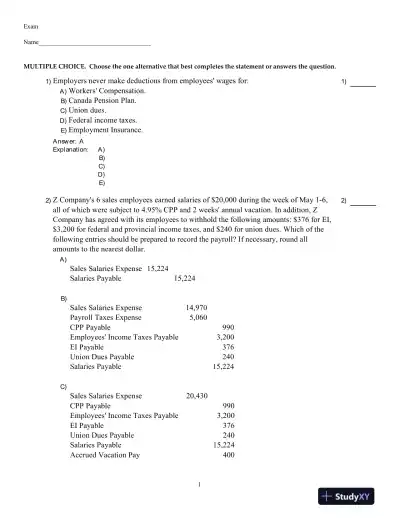

Fundamental Accounting Principles, Vol 1, 15th Edition Test Bank makes studying simple and effective with structured explanations and a clear study plan.

Loading page ...

This document has 633 pages. Sign in to access the full document!