Page 1

Loading page ...

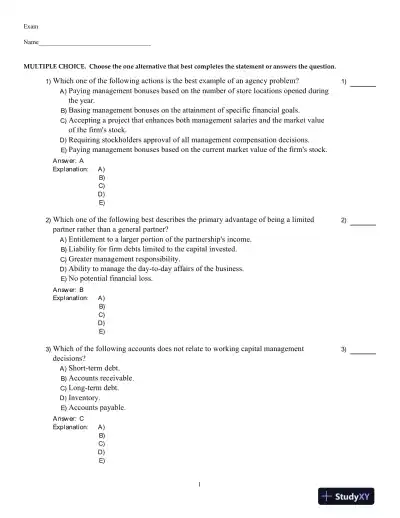

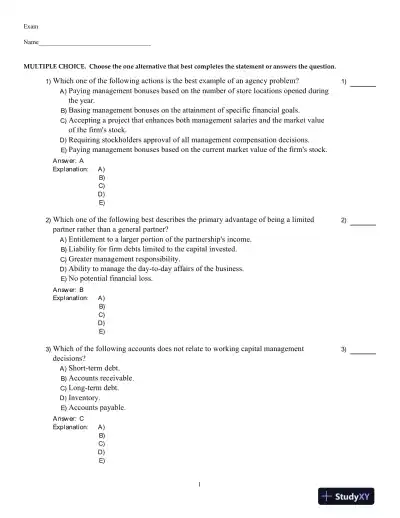

Develop a deep understanding of exam topics with Fundamentals Of Corporate Finance, Ninth Canadian Edition Test Bank, a complete study and practice guide.

Loading page ...

This document has 1583 pages. Sign in to access the full document!