Page 1

Loading page ...

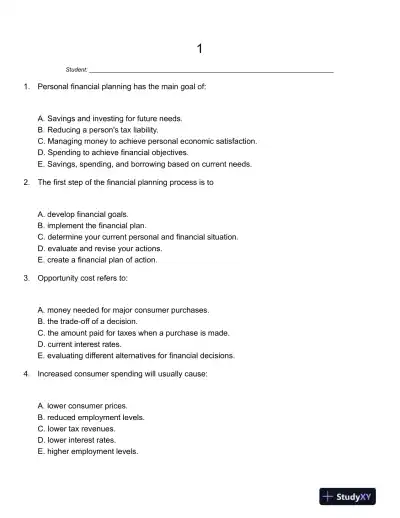

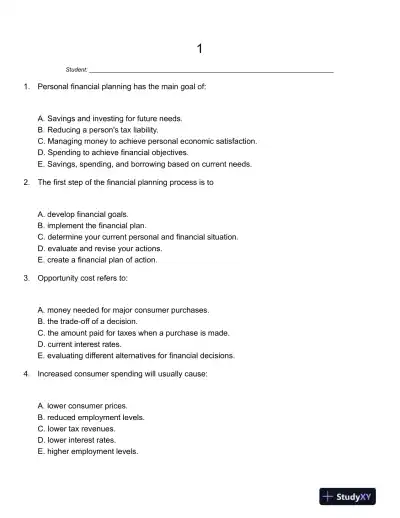

Get exam-ready with Personal Finance 6th Canadian Edition Test Bank, featuring clear concepts, step-by-step solutions, and study tips from experts.

Loading page ...

This document has 761 pages. Sign in to access the full document!