Page 1

Loading page ...

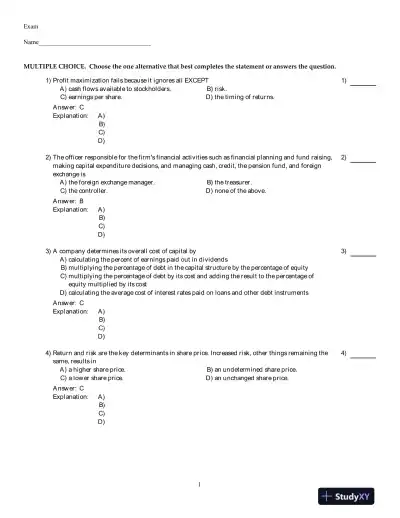

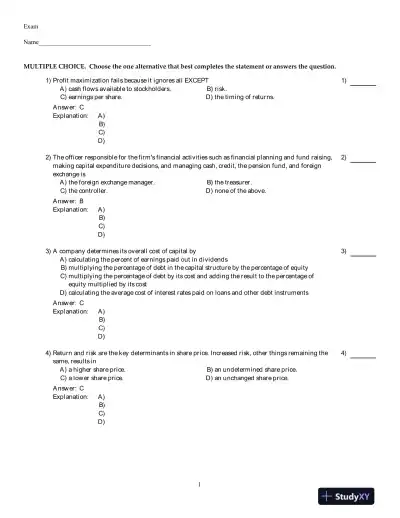

Principles Of Corporate Finance, Second Canadian Edition Test Bank is a powerful exam tool, providing structured learning, revision notes, and real-world examples.

Loading page ...

This document has 840 pages. Sign in to access the full document!