Page 1

Loading page ...

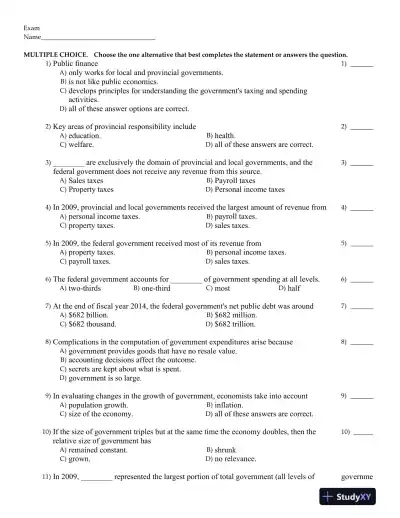

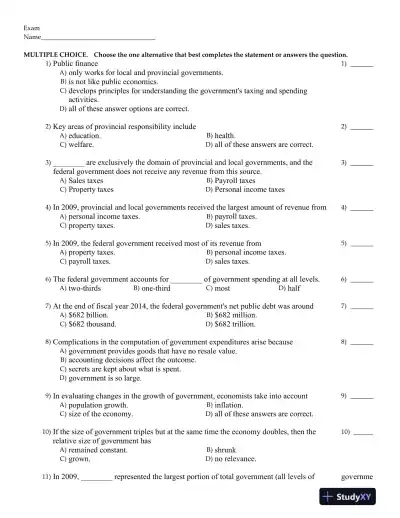

Public Finance in Canada 5th Edition Test Bank makes learning easy with a structured format, concise explanations, and plenty of practice material.

Loading page ...

This document has 117 pages. Sign in to access the full document!