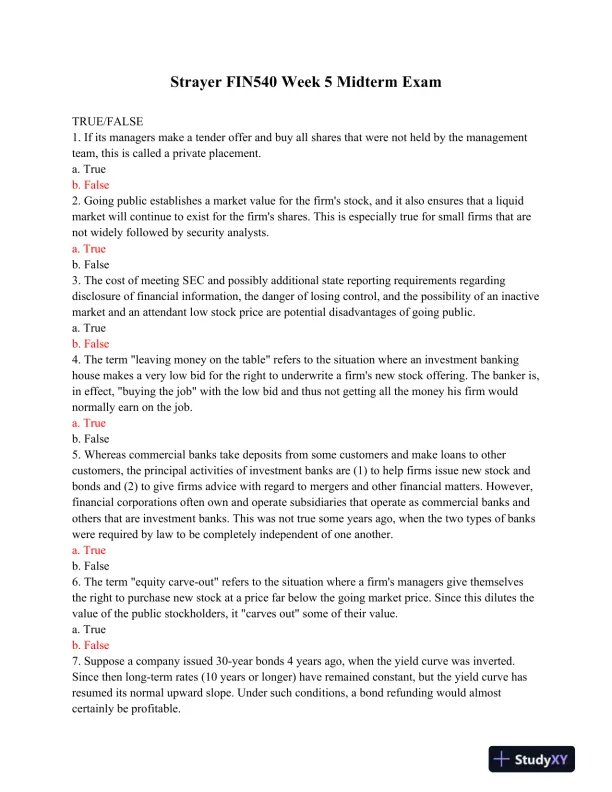

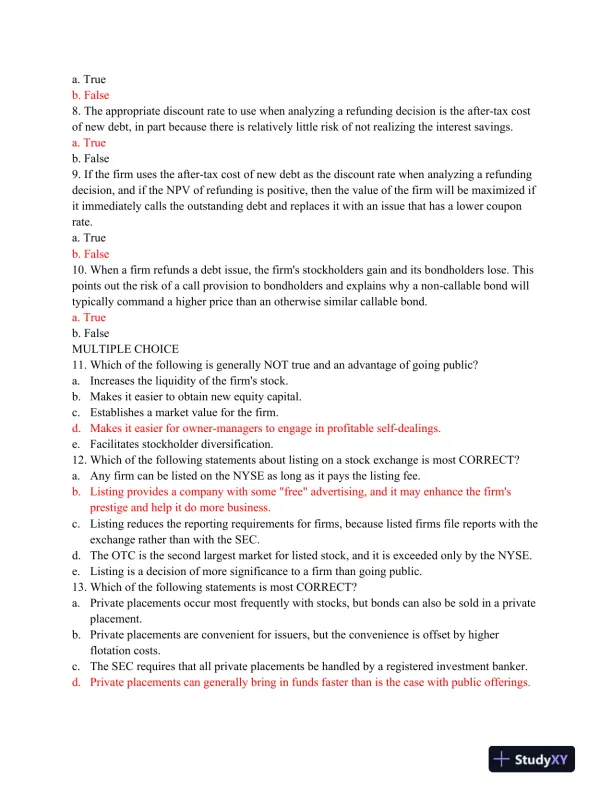

Page 1

Loading page image...

Page 2

Loading page image...

Page 3

Loading page image...

Solved midterm exam covering financial principles in FIN540 at Strayer University.

Loading page image...

Loading page image...

Loading page image...

This document has 7 pages. Sign in to access the full document!