Page 1

Loading page ...

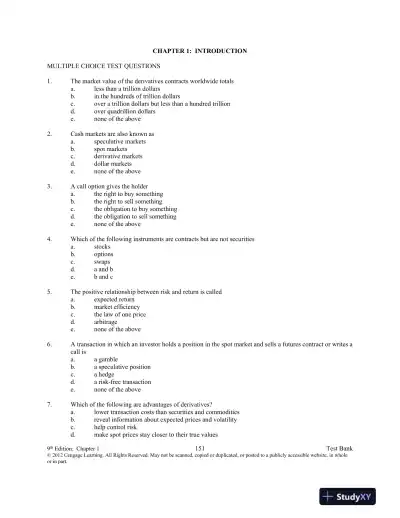

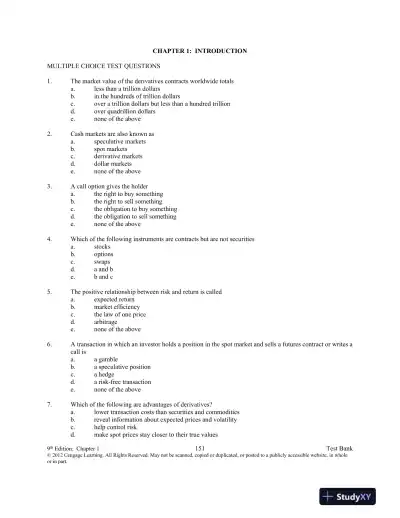

Study stress-free with Test Bank For Introduction To Derivatives And Risk Management, 9th Edition, a concise and easy-to-follow exam guide tailored for success.

Loading page ...

This document has 128 pages. Sign in to access the full document!