Page 1

Loading page ...

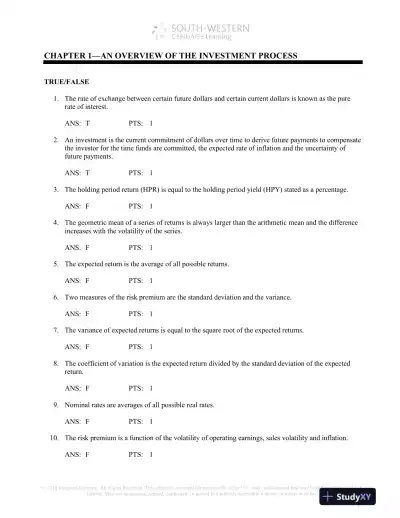

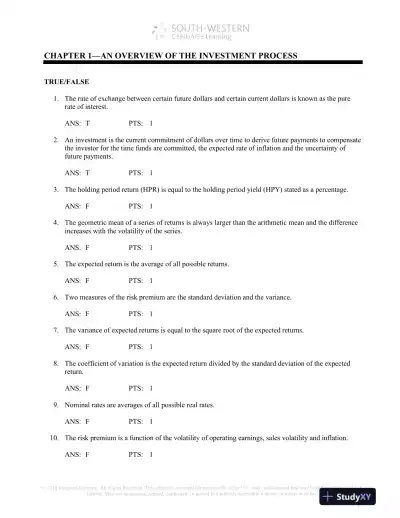

Stay on top of your exam prep with Test Bank For Investment Analysis And Portfolio Management, 10th Edition, featuring expert advice, key notes, and practice tests.

Loading page ...

This document has 555 pages. Sign in to access the full document!