Page 1

Loading page ...

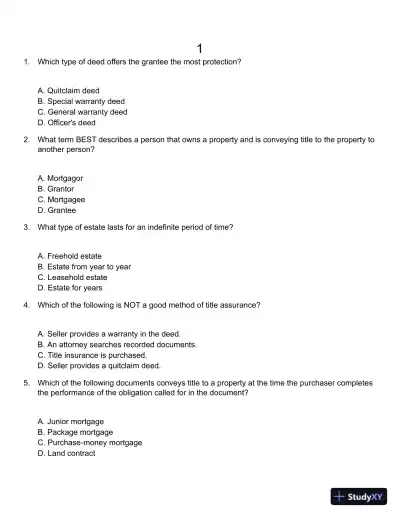

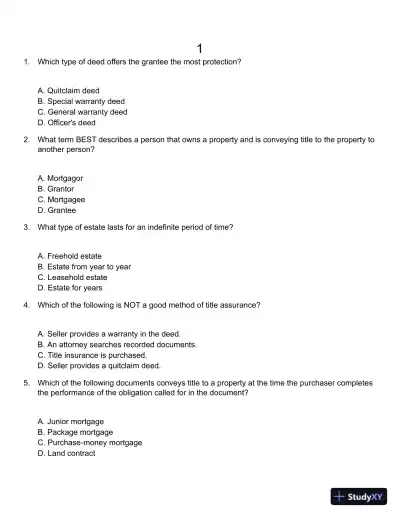

Prepare for your exam efficiently with Test Bank For Real Estate Finance And Investments, 14th Edition, featuring a range of test questions and solutions.

Loading page ...

This document has 238 pages. Sign in to access the full document!