Page 1

Loading page image...

Page 2

Loading page image...

Page 3

Loading page image...

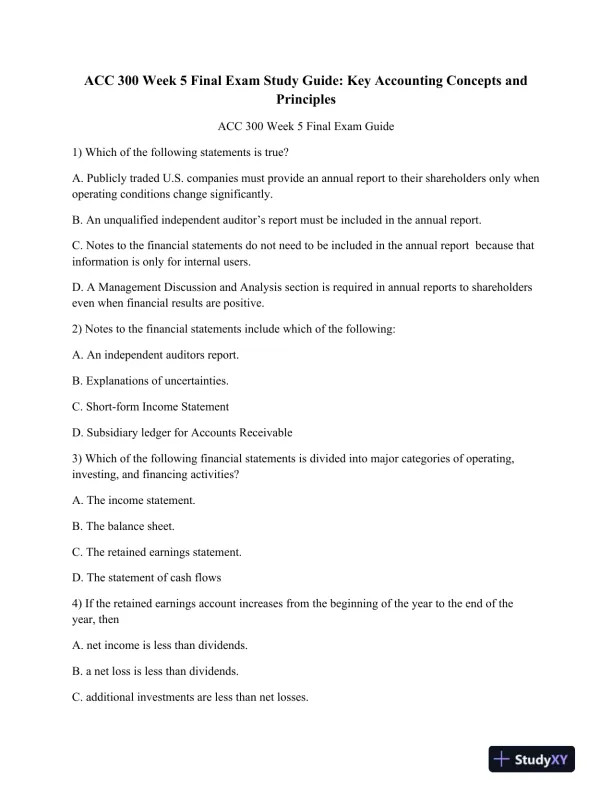

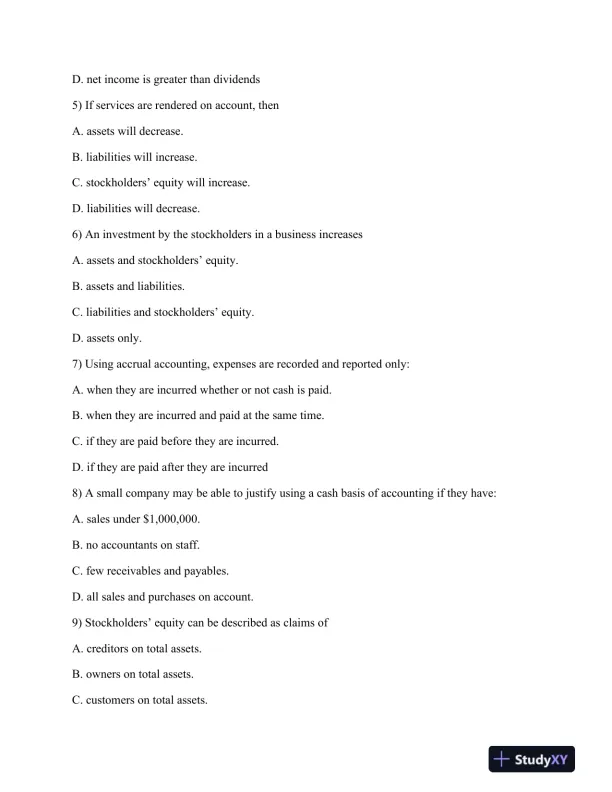

Study guide for final exam on key accounting principles.

Loading page image...

Loading page image...

Loading page image...

This document has 9 pages. Sign in to access the full document!