Page 1

Loading page image...

Page 2

Loading page image...

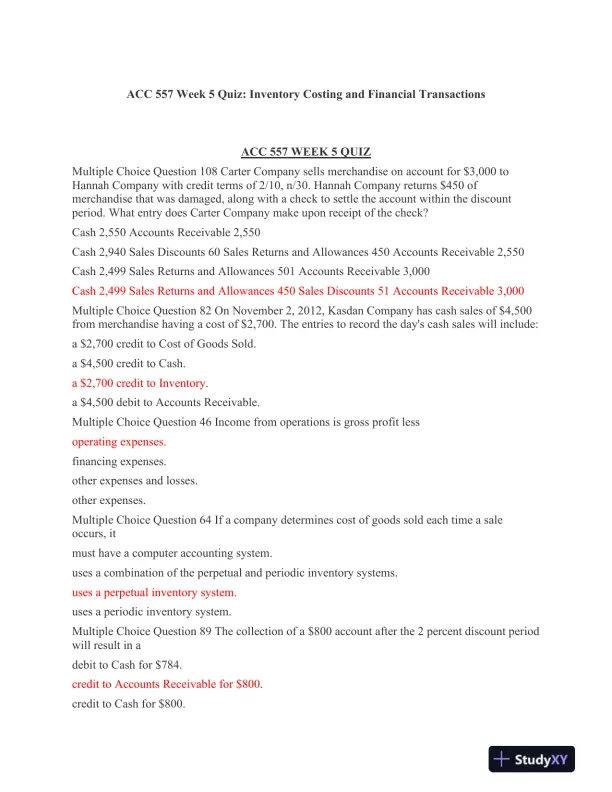

A quiz that tests knowledge on inventory costing methods and related financial transactions.

Loading page image...

Loading page image...

This document has 5 pages. Sign in to access the full document!