Page 1

Loading page image...

Page 2

Loading page image...

Page 3

Loading page image...

Page 4

Loading page image...

Page 5

Loading page image...

Page 6

Loading page image...

Page 7

Loading page image...

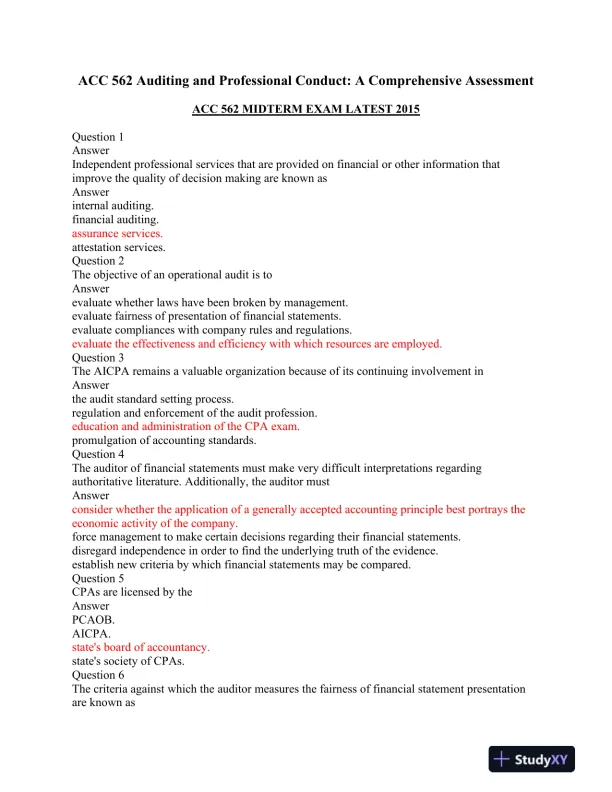

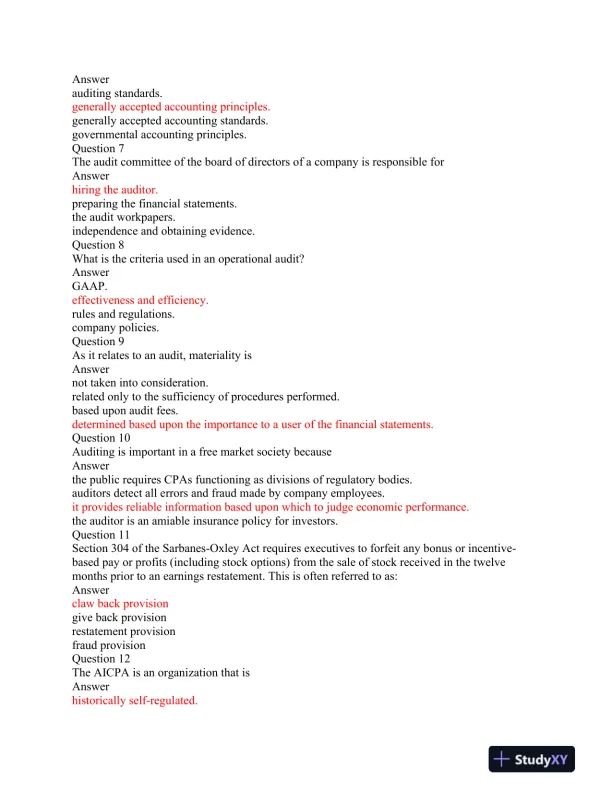

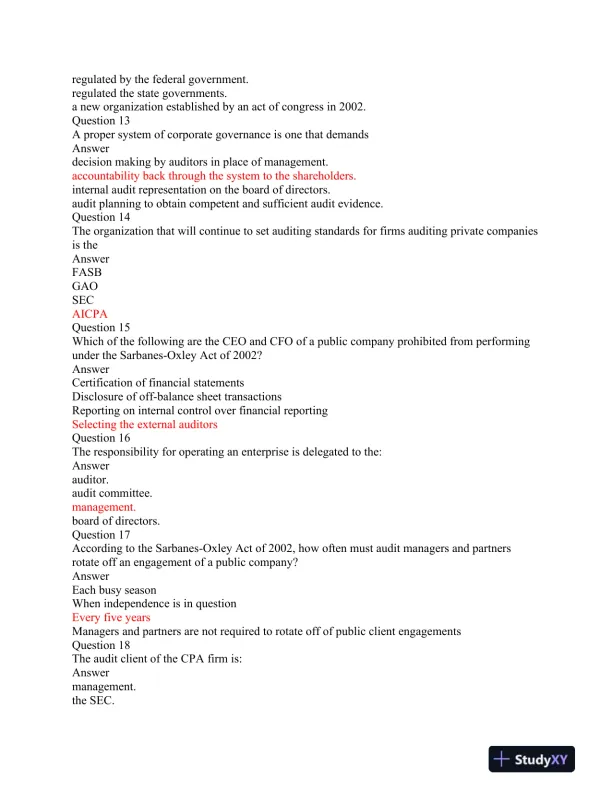

This assessment evaluates auditing practices and the professional conduct of auditors in compliance with industry standards.

Loading page image...

Loading page image...

Loading page image...

Loading page image...

Loading page image...

Loading page image...

Loading page image...

This document has 20 pages. Sign in to access the full document!