Page 1

Loading page image...

Page 2

Loading page image...

Page 3

Loading page image...

Page 4

Loading page image...

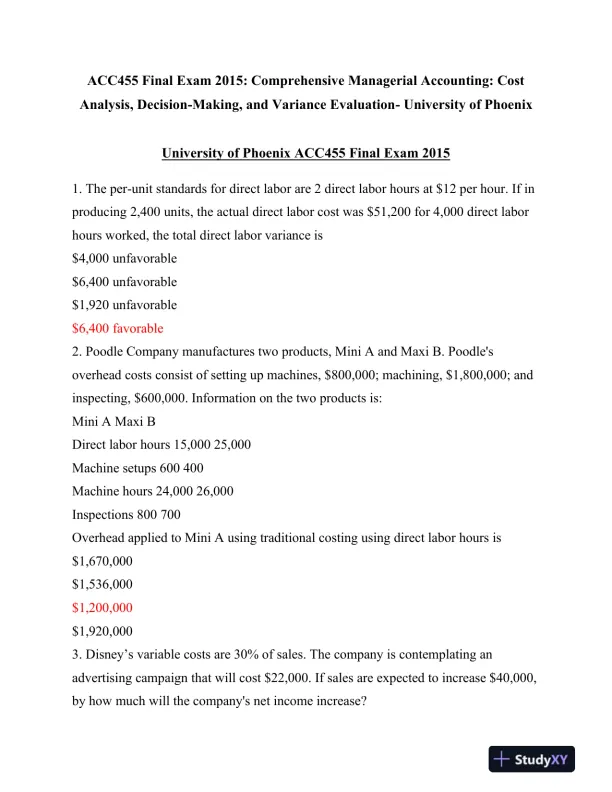

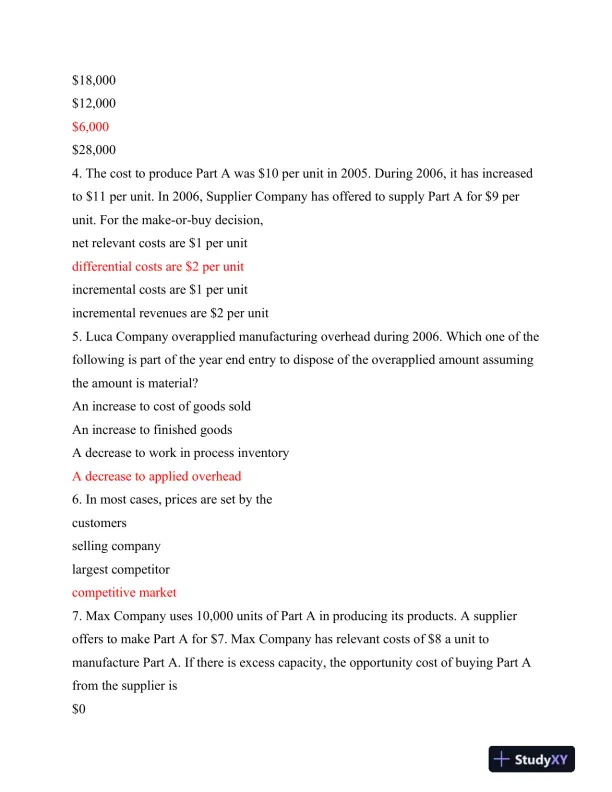

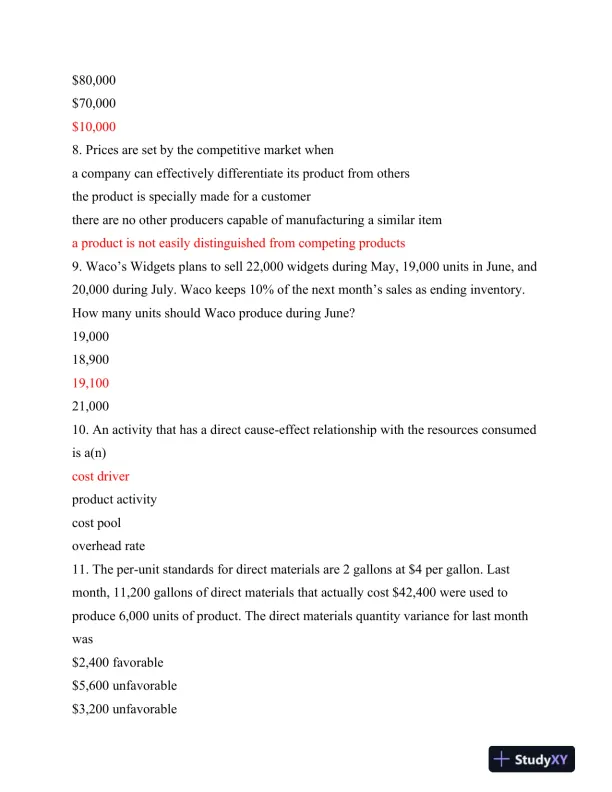

A comprehensive exam review of managerial accounting, focusing on cost analysis, decision-making, and variance evaluation.

Loading page image...

Loading page image...

Loading page image...

Loading page image...

This document has 13 pages. Sign in to access the full document!