Page 1

Loading page image...

Page 2

Loading page image...

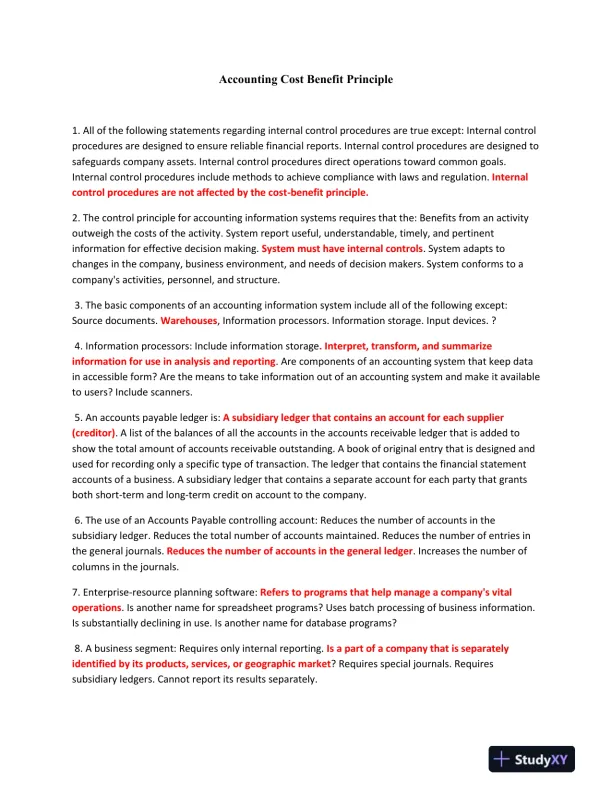

This paper explores the cost-benefit principle in accounting, focusing on its application in financial decision-making.

Loading page image...

Loading page image...

This document has 3 pages. Sign in to access the full document!