Page 1

Loading page image...

Page 2

Loading page image...

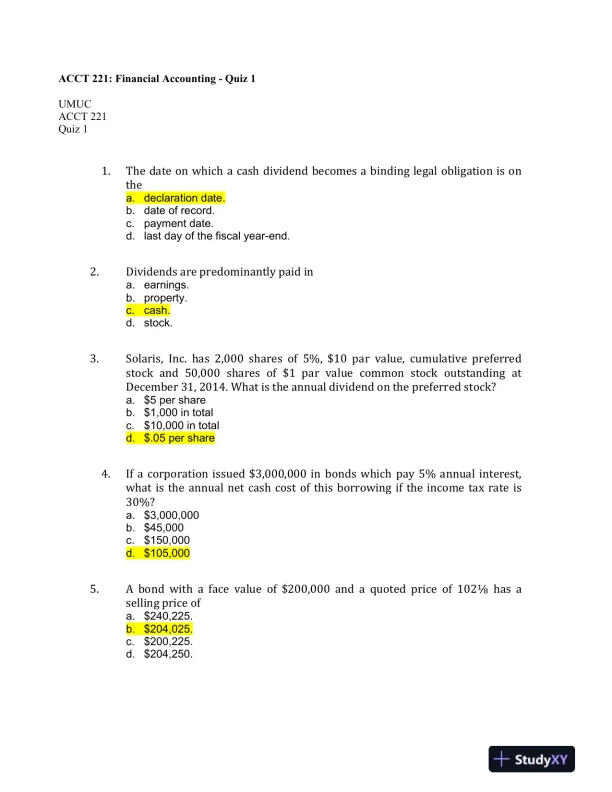

A quiz covering key financial accounting concepts, including fundamental accounting principles and transactions.

Loading page image...

Loading page image...

This document has 3 pages. Sign in to access the full document!