Page 1

Loading page image...

Page 2

Loading page image...

Page 3

Loading page image...

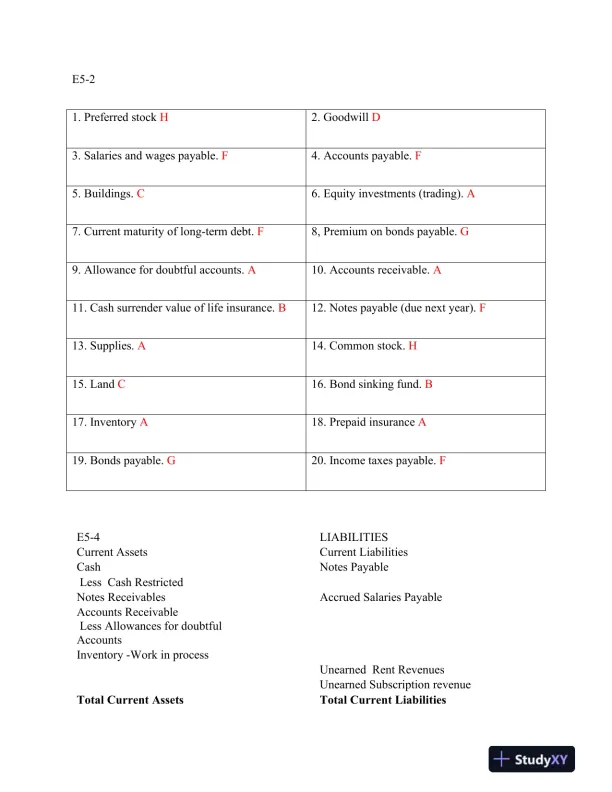

Description: This paper covers fundamental concepts in intermediate accounting, focusing on financial statements and processes.

Loading page image...

Loading page image...

Loading page image...

This document has 8 pages. Sign in to access the full document!