Page 1

Loading page image...

Page 2

Loading page image...

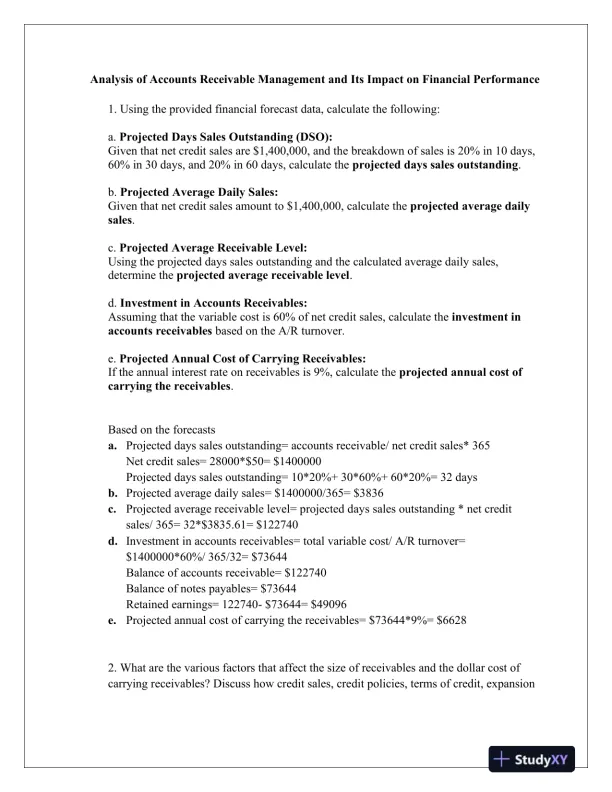

This paper analyzes accounts receivable management and its impact on a company's financial performance.

Loading page image...

Loading page image...

This document has 4 pages. Sign in to access the full document!