Page 1

Loading page ...

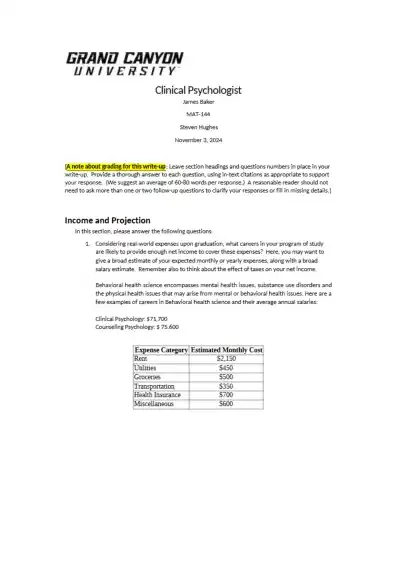

Grand Canyon University MAT-144 assignment “Clinical Psychologist” by Steven Hughes (Nov 3, 2024). Includes grading notes and an “Income and Projection” section with behavioral health salary estimates and a monthly expense budget table.

Loading page ...

This document has 5 pages. Sign in to access the full document!