Page 1

Loading page image...

Page 2

Loading page image...

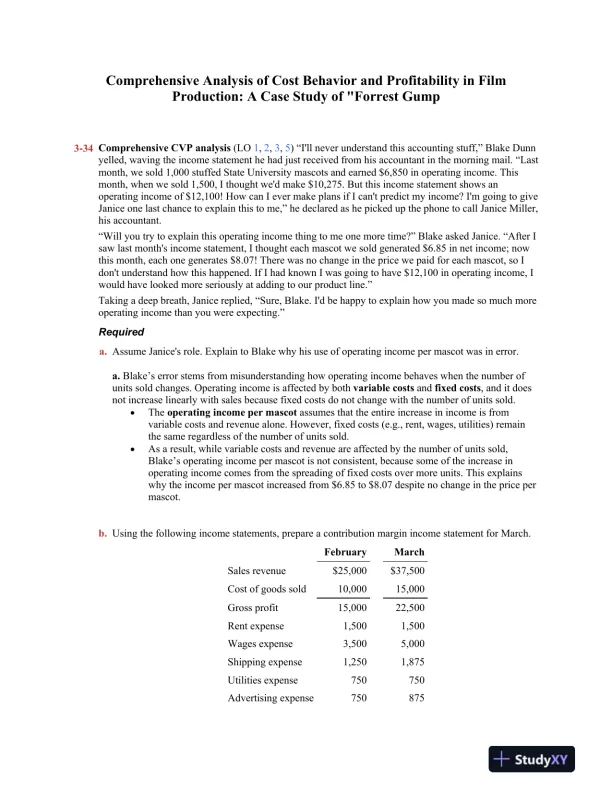

A detailed analysis of cost behavior and profitability in film production, using "Forrest Gump" as a case study.

Loading page image...

Loading page image...

This document has 6 pages. Sign in to access the full document!