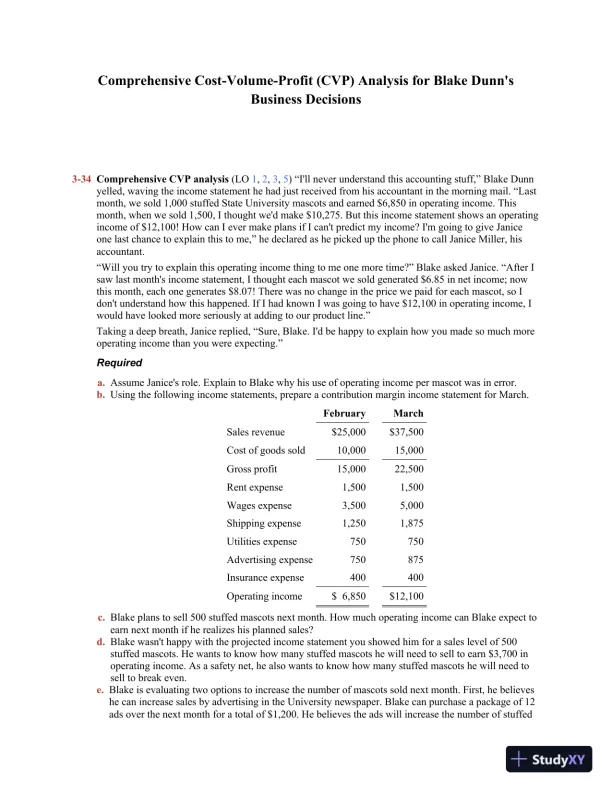

Page 1

Loading page image...

Page 2

Loading page image...

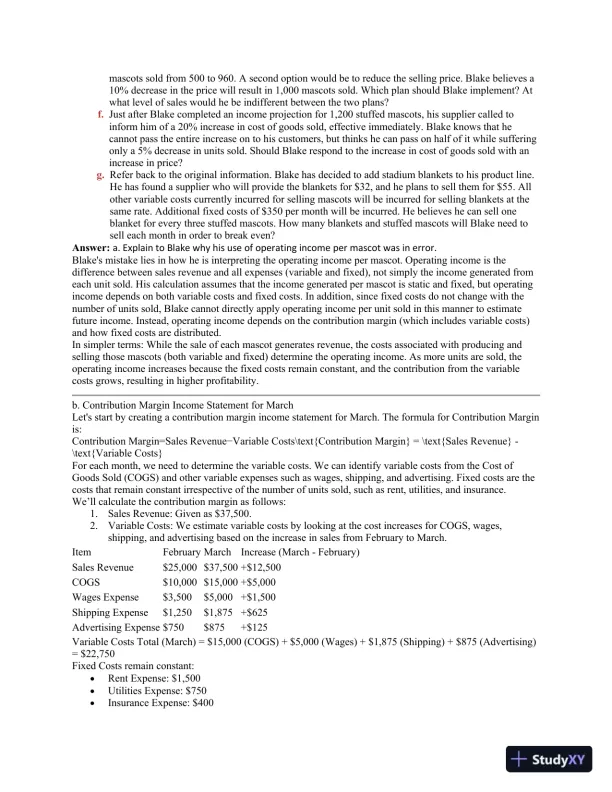

Page 3

Loading page image...

This Solved Assignment explains CVP analysis for better business decision-making. Get it today!

Loading page image...

Loading page image...

Loading page image...

This document has 9 pages. Sign in to access the full document!