Page 1

Loading page ...

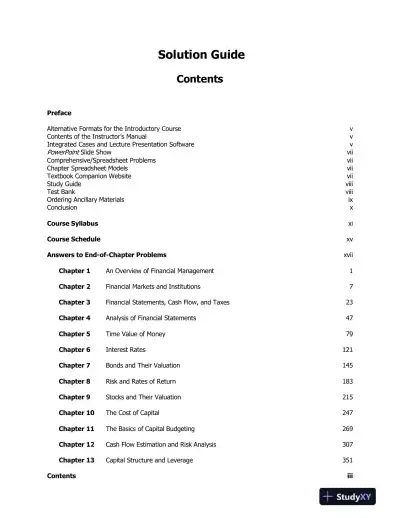

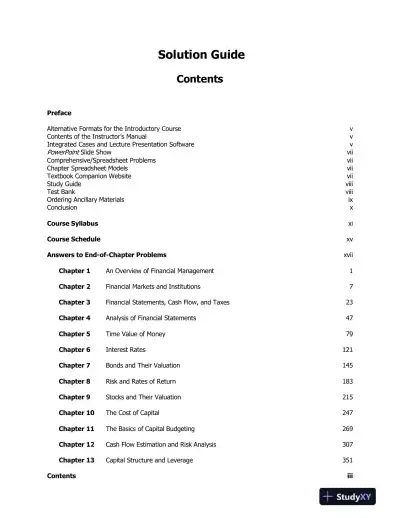

Fundamentals Of Financial Management, Concise, 8th Edition Solution Manual is packed with key takeaways, summaries, and study tips for effective learning.

Loading page ...

This document has 545 pages. Sign in to access the full document!