Page 1

Loading page ...

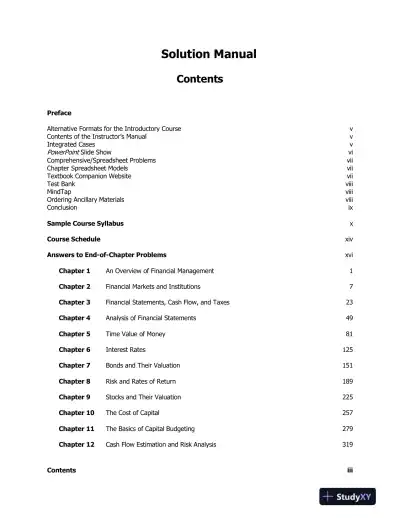

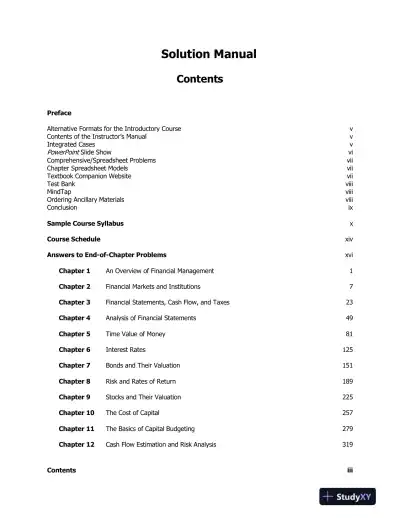

Enhance your learning experience with Solution Manual For Fundamentals of Financial Management, 15th Edition, covering all essential textbook topics.

Loading page ...

This document has 601 pages. Sign in to access the full document!