Page 1

Loading page image...

Page 2

Loading page image...

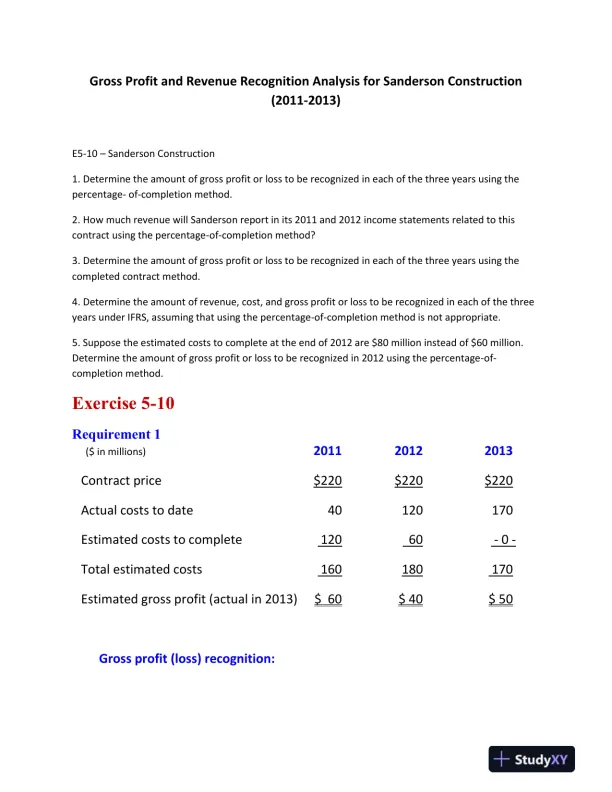

The assignment analyzes the gross profit and revenue recognition practices for Sanderson Construction from 2011 to 2013.

Loading page image...

Loading page image...

This document has 3 pages. Sign in to access the full document!