Page 1

Loading page image...

Page 2

Loading page image...

Page 3

Loading page image...

Page 4

Loading page image...

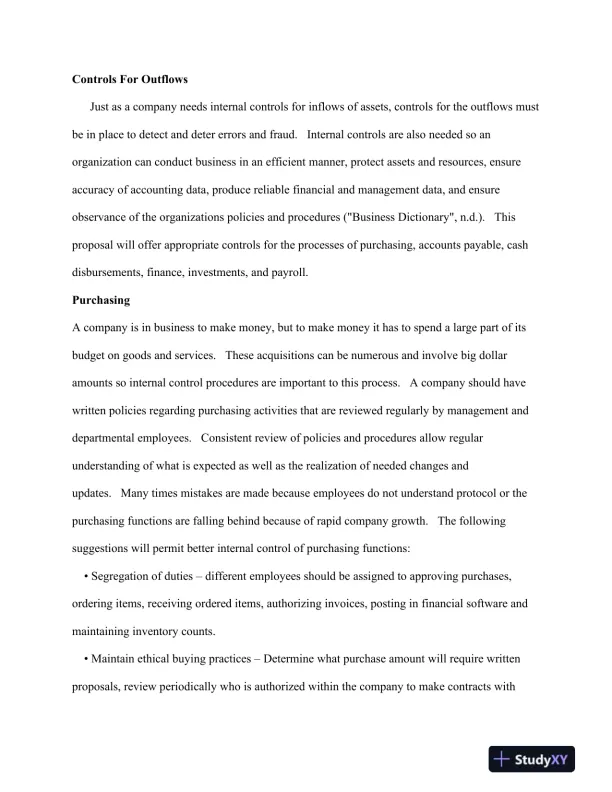

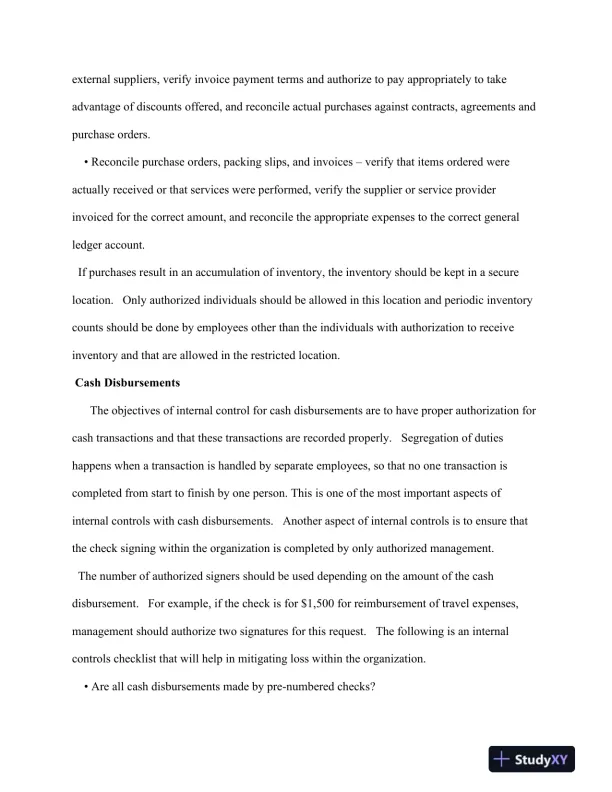

Description: This paper examines the implementation of internal controls to mitigate risks in business operations.

Loading page image...

Loading page image...

Loading page image...

Loading page image...

This document has 10 pages. Sign in to access the full document!