Page 1

Loading page image...

Page 2

Loading page image...

Page 3

Loading page image...

Page 4

Loading page image...

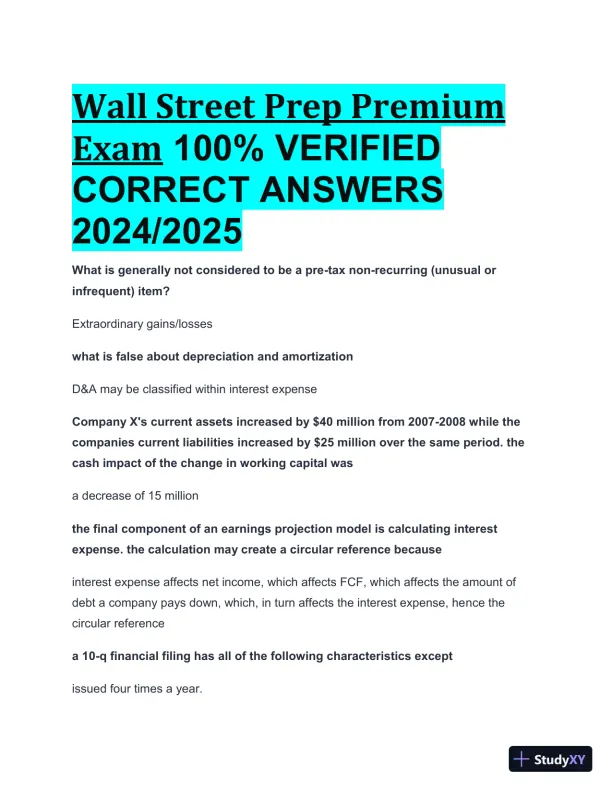

2024-2025 Wall Street Prep Premium Exam with Answers helps you build confidence by practicing with past papers.

Loading page image...

Loading page image...

Loading page image...

Loading page image...

This document has 13 pages. Sign in to access the full document!