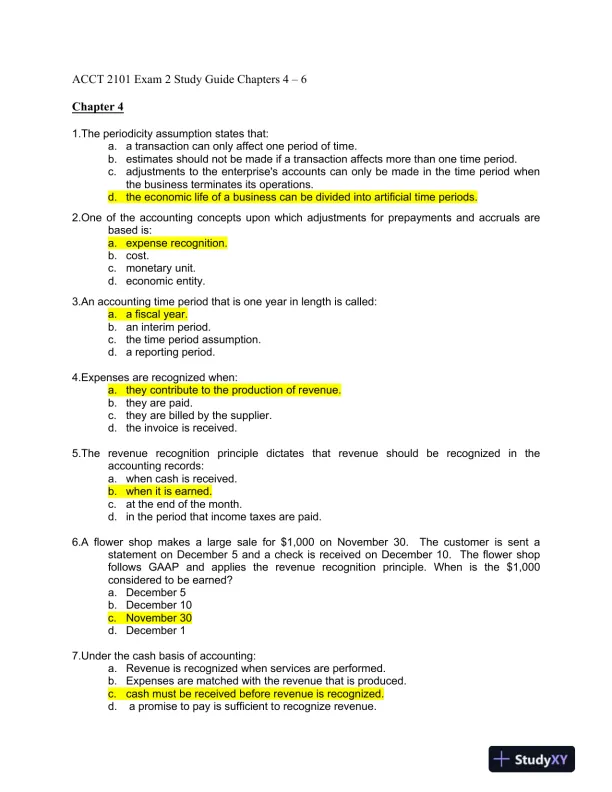

Page 1

Loading page image...

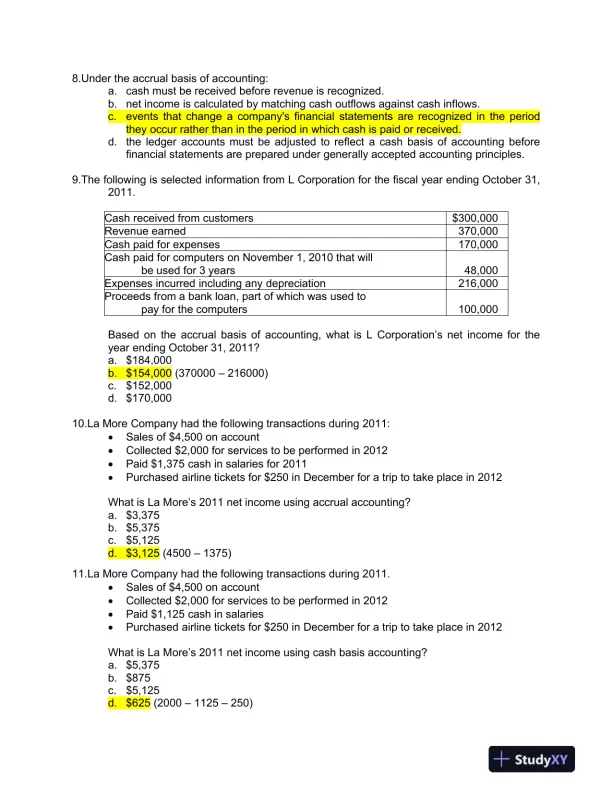

Page 2

Loading page image...

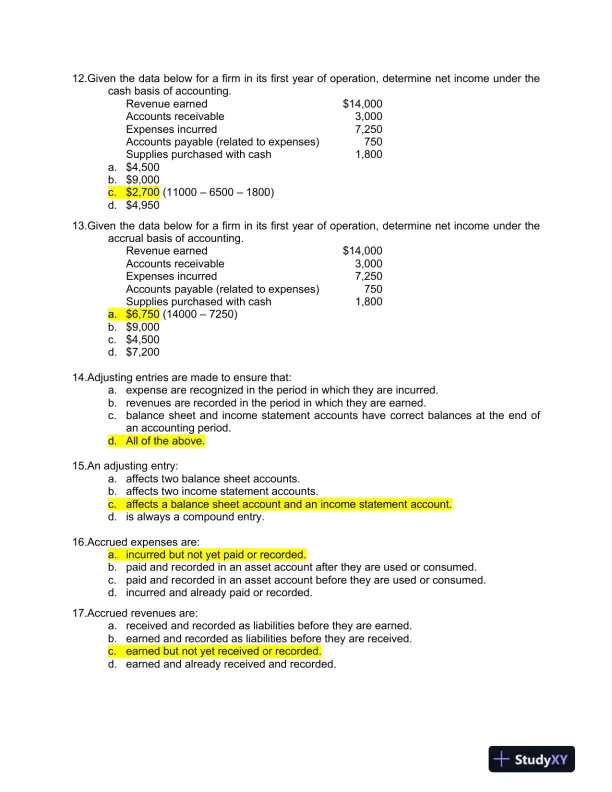

Page 3

Loading page image...

Page 4

Loading page image...

Comprehensive review materials covering intermediate accounting concepts and principles

Loading page image...

Loading page image...

Loading page image...

Loading page image...

This document has 11 pages. Sign in to access the full document!