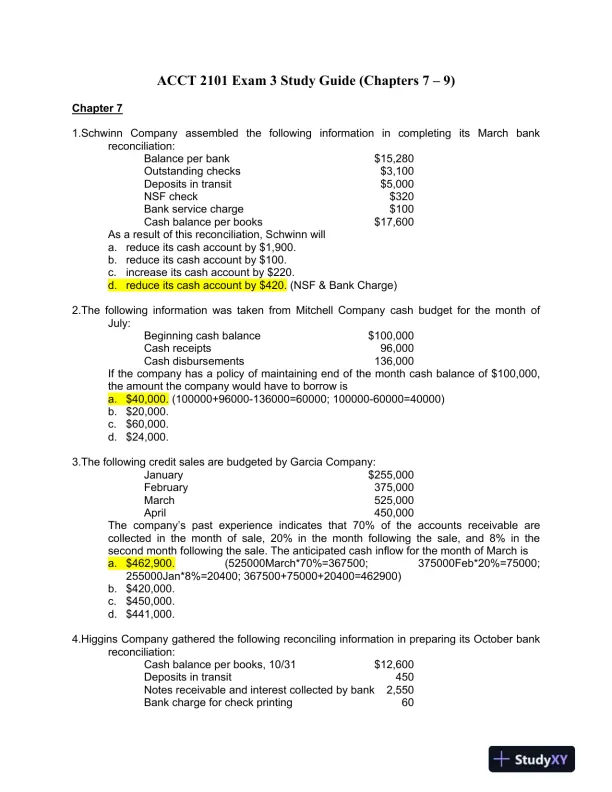

Page 1

Loading page image...

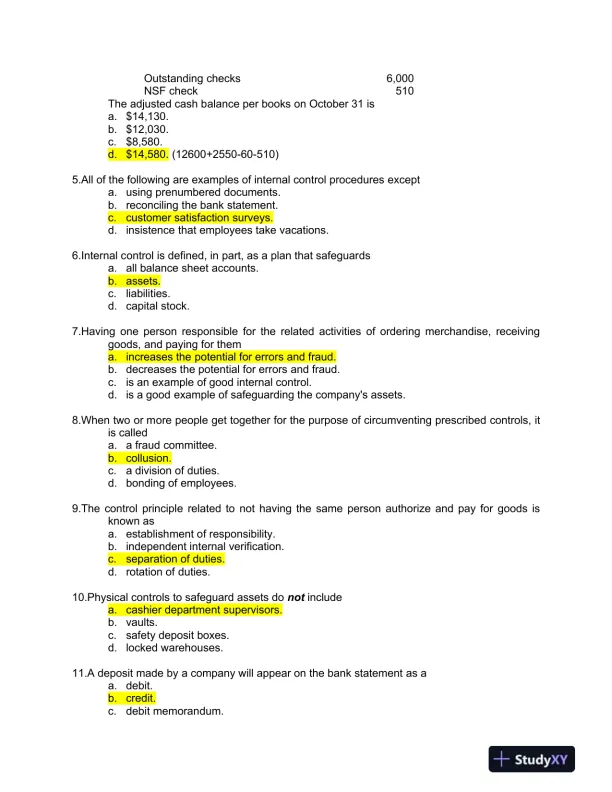

Page 2

Loading page image...

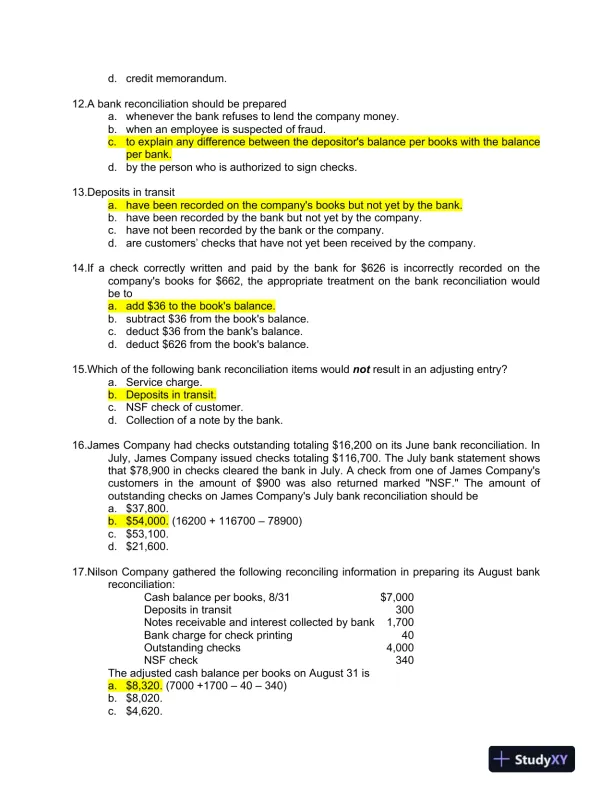

Page 3

Loading page image...

Page 4

Loading page image...

A comprehensive study guide with solved questions for Exam 3 in ACCT 2101.

Loading page image...

Loading page image...

Loading page image...

Loading page image...

This document has 11 pages. Sign in to access the full document!