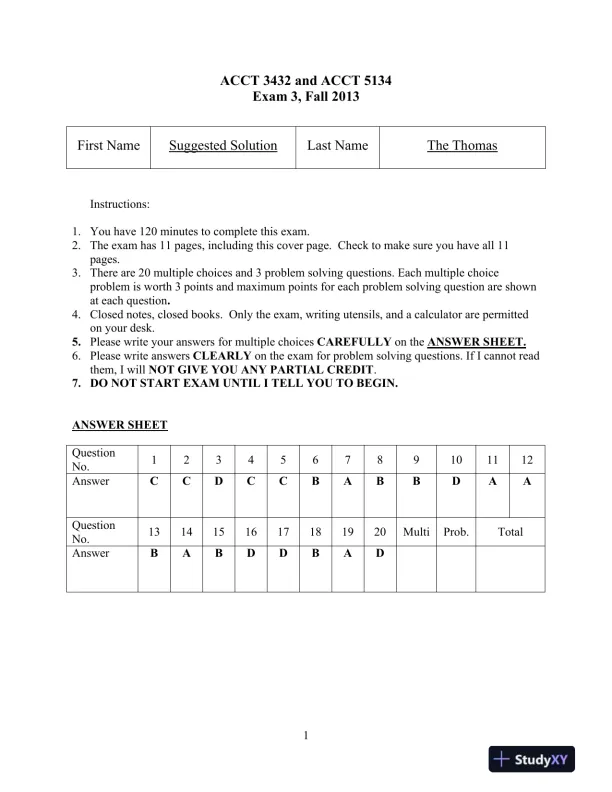

Page 1

Loading page image...

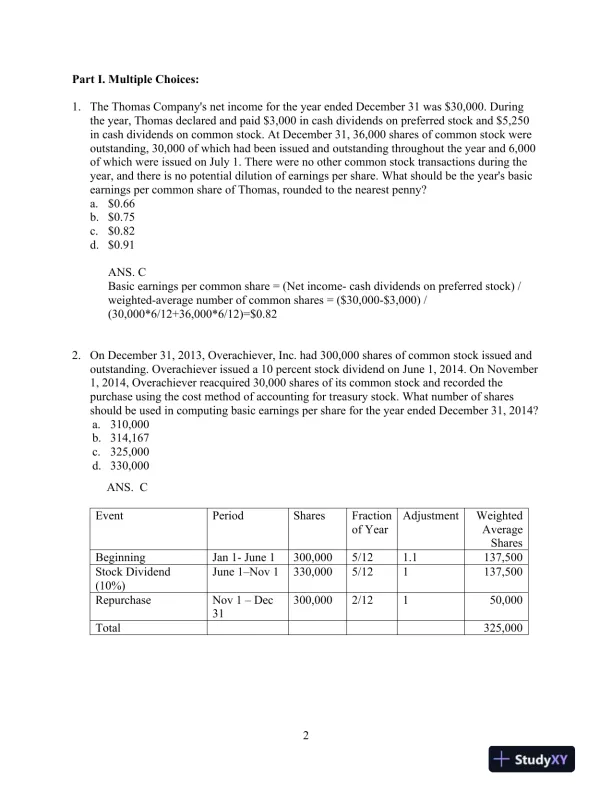

Page 2

Loading page image...

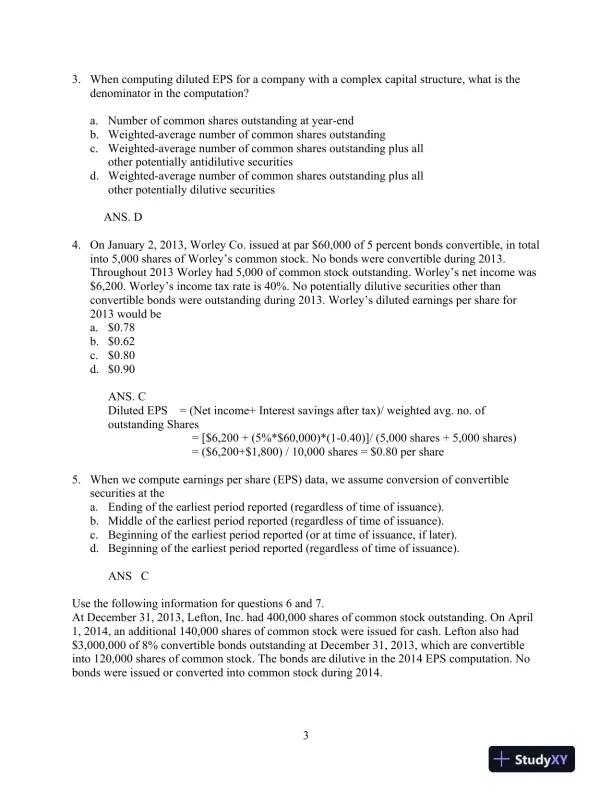

Page 3

Loading page image...

Page 4

Loading page image...

A solved Exam 3 from Fall 2013 covering key accounting concepts in financial reporting.

Loading page image...

Loading page image...

Loading page image...

Loading page image...

This document has 12 pages. Sign in to access the full document!