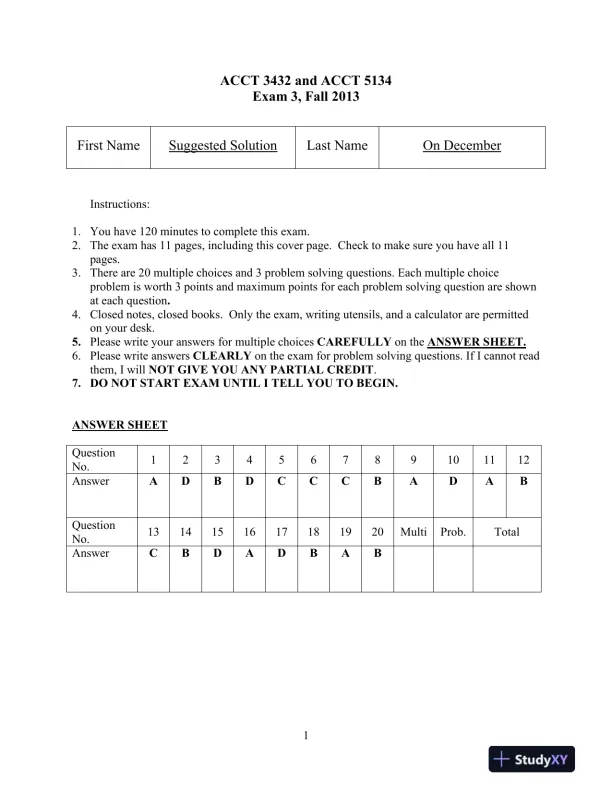

Page 1

Loading page image...

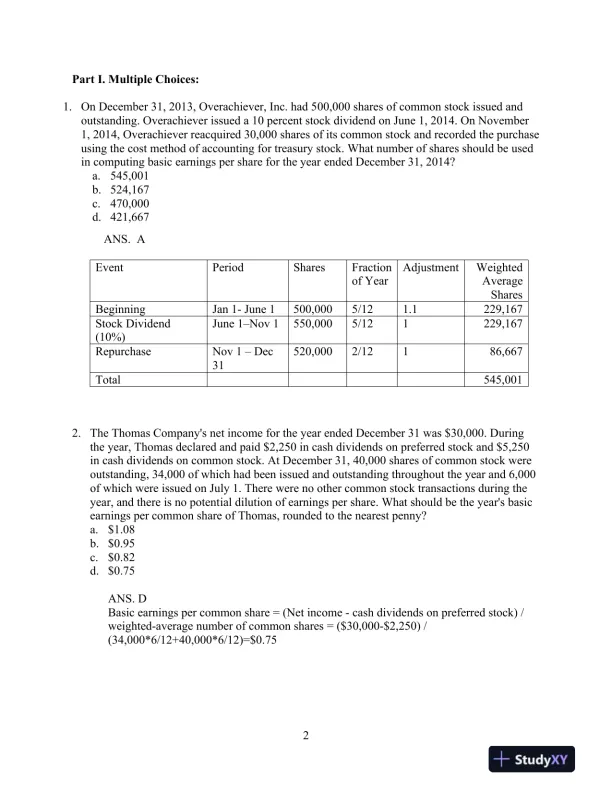

Page 2

Loading page image...

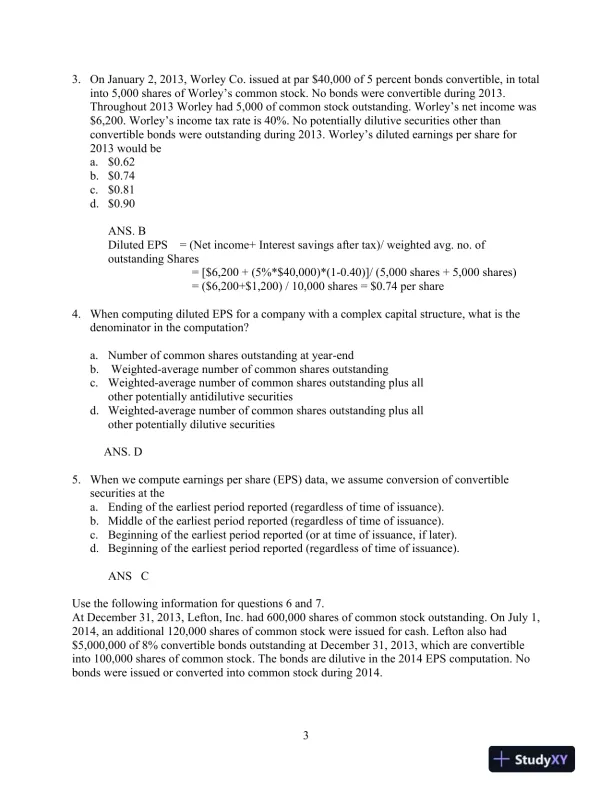

Page 3

Loading page image...

Page 4

Loading page image...

A solved Exam 3 for ACCT 3432 and ACCT 5134 from Fall 2013, covering key financial topics.

Loading page image...

Loading page image...

Loading page image...

Loading page image...

This document has 12 pages. Sign in to access the full document!