Page 1

Loading page ...

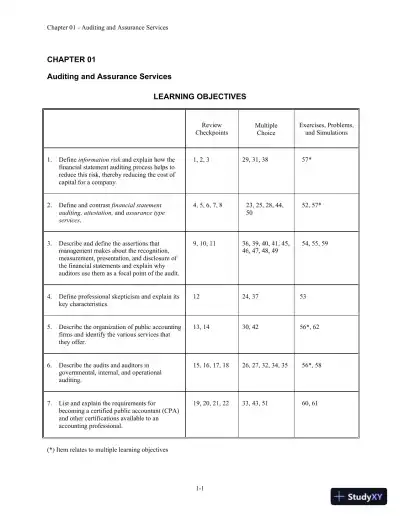

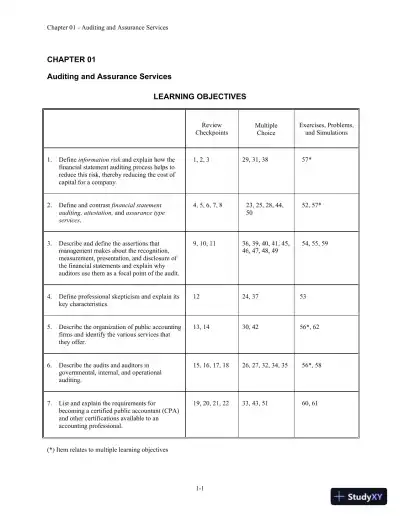

Auditing and Assurance Services 6th Edition Solution Manual offers a comprehensive guide to solving every question in your textbook, helping you master the material.

Loading page ...

This document has 562 pages. Sign in to access the full document!