Page 1

Loading page image...

Page 2

Loading page image...

Page 3

Loading page image...

Page 4

Loading page image...

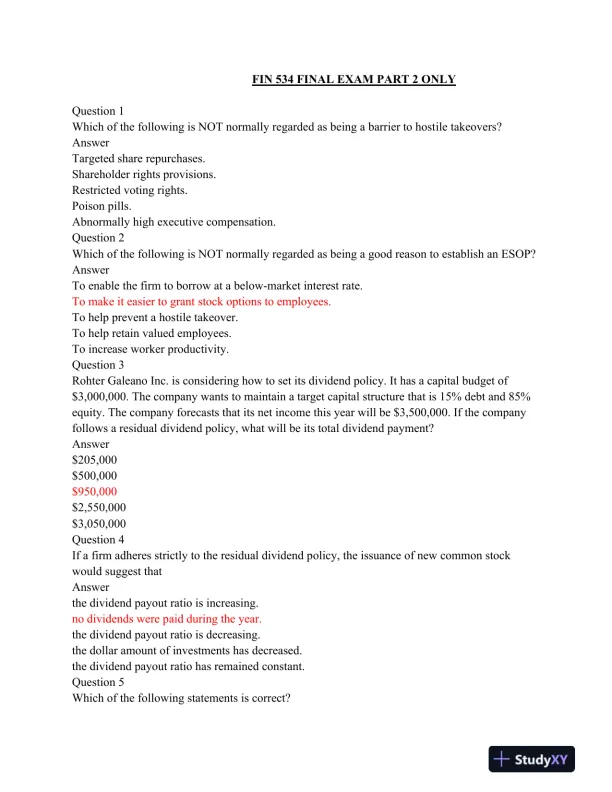

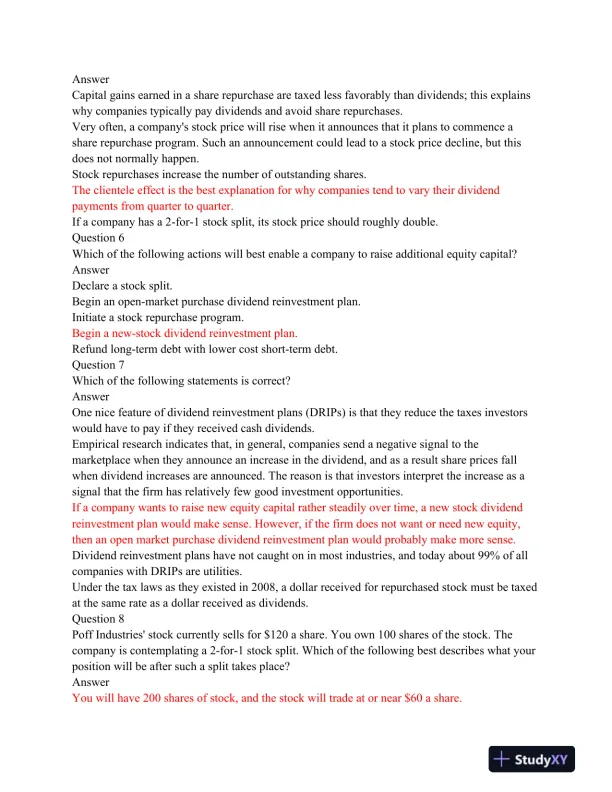

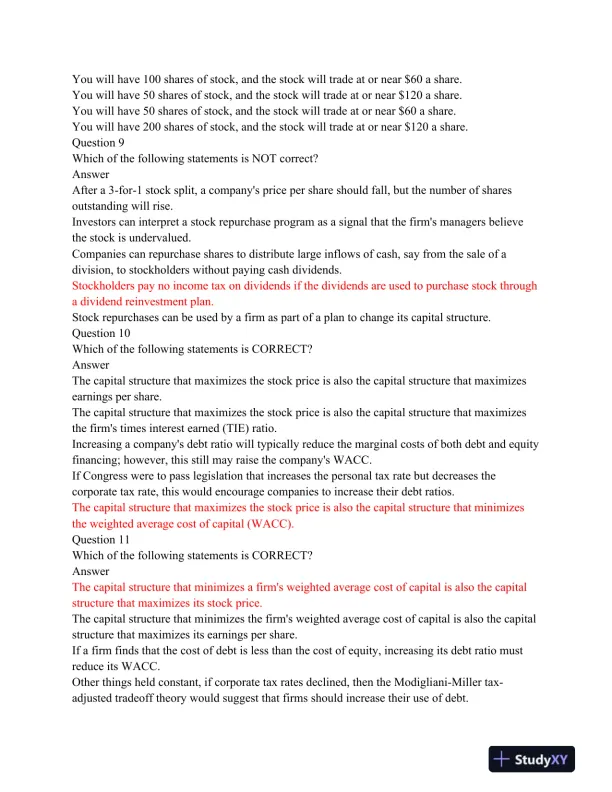

The second part of a final exam on financial management.

Loading page image...

Loading page image...

Loading page image...

Loading page image...

This document has 10 pages. Sign in to access the full document!