Page 1

Loading page image...

Page 2

Loading page image...

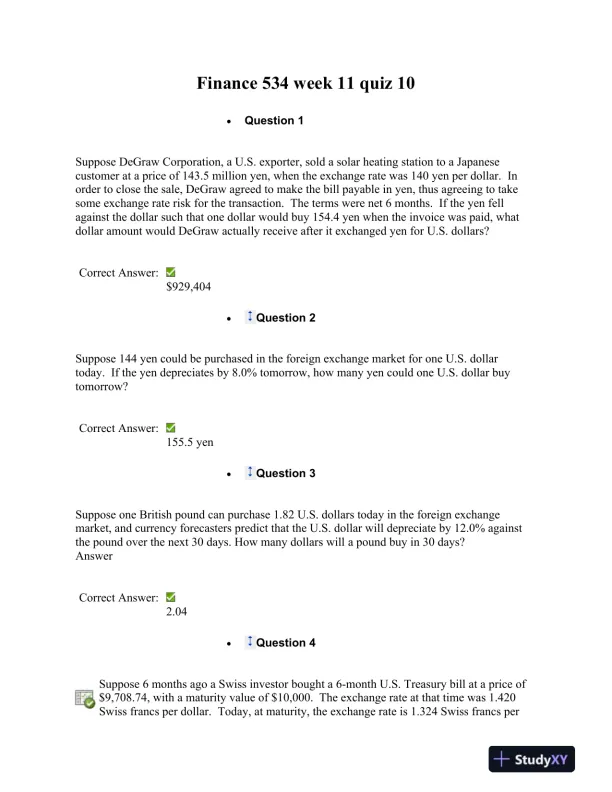

A finance quiz covering key concepts from Week 11, designed to test understanding of financial principles.

Loading page image...

Loading page image...

This document has 4 pages. Sign in to access the full document!