Page 1

Loading page image...

Page 2

Loading page image...

Page 3

Loading page image...

Page 4

Loading page image...

Page 5

Loading page image...

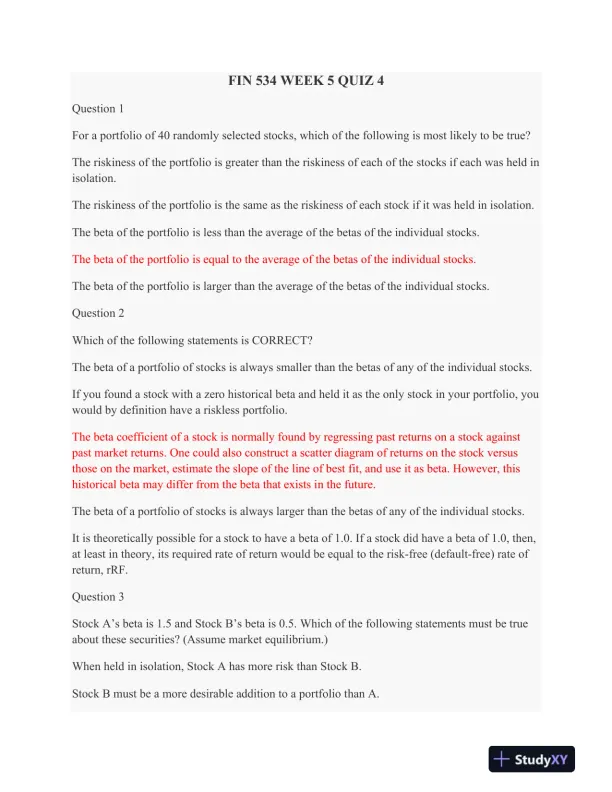

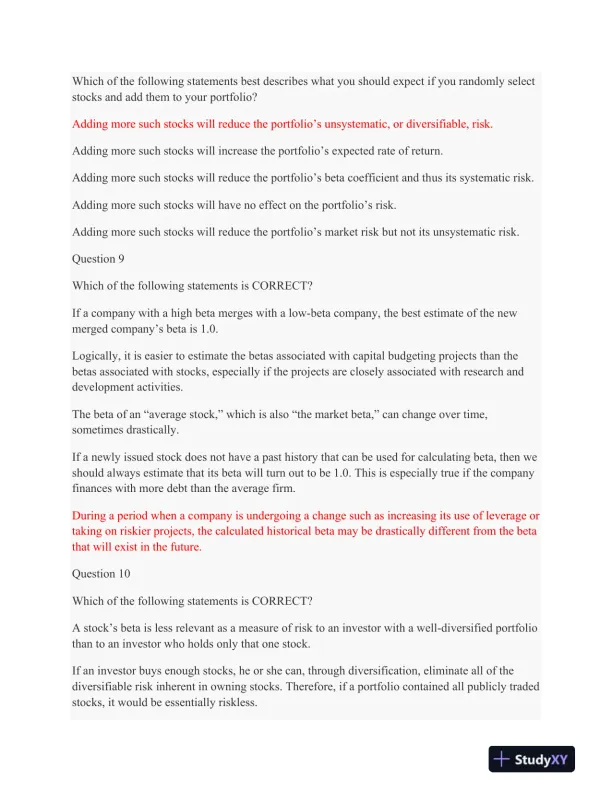

A finance quiz assessing knowledge of concepts covered in Week 5 of FIN 534.

Loading page image...

Loading page image...

Loading page image...

Loading page image...

Loading page image...

This document has 14 pages. Sign in to access the full document!