Page 1

Loading page ...

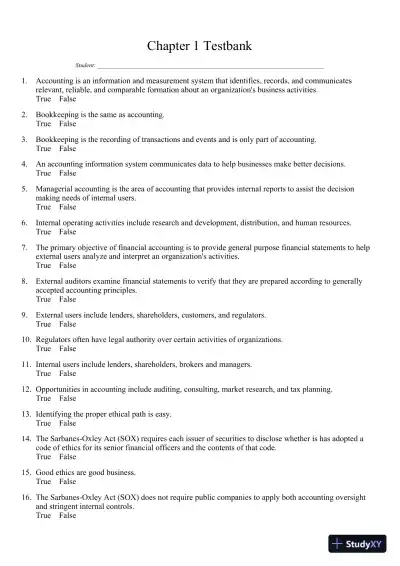

Fundamental Accounting Principles 19th Edition Test Bank is an essential resource to help you tackle your upcoming exams with confidence. This guide includes key questions and answers to boost your exam preparation.

Loading page ...

This document has 1517 pages. Sign in to access the full document!