Page 1

Loading page ...

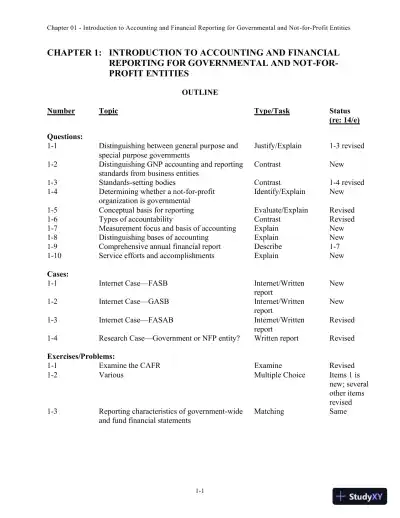

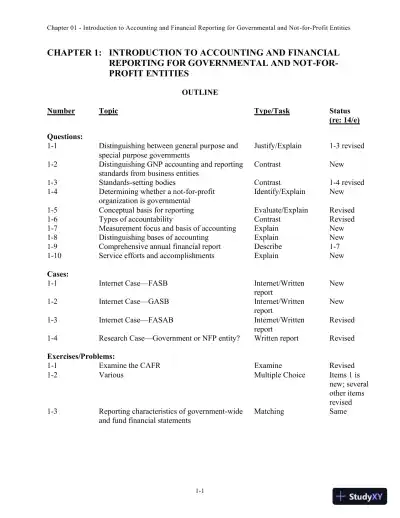

Solution Manual for Accounting for Governmental and Nonprofit Entities, 15th edition provides expert-verified solutions to help you study smarter.

Loading page ...

This document has 347 pages. Sign in to access the full document!