Page 1

Loading page image...

Page 2

Loading page image...

Page 3

Loading page image...

Page 4

Loading page image...

Page 5

Loading page image...

Page 6

Loading page image...

Page 7

Loading page image...

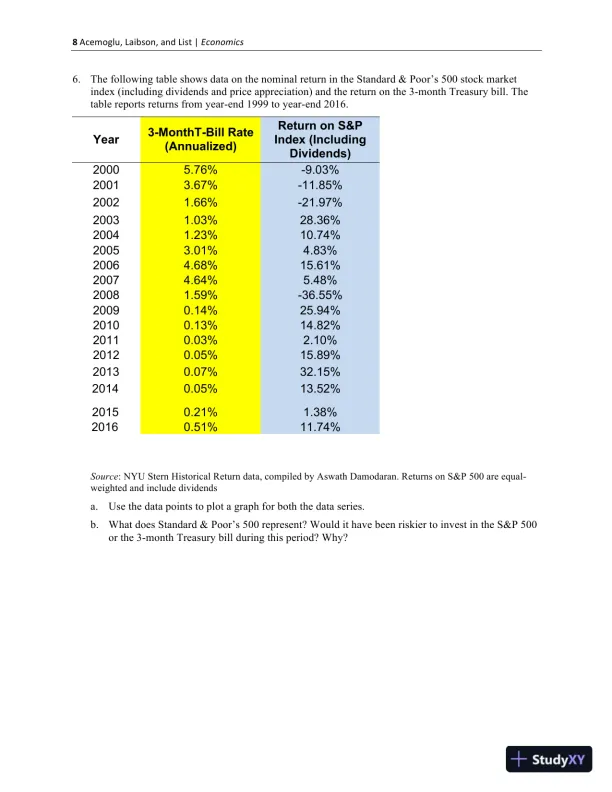

Page 8

Loading page image...

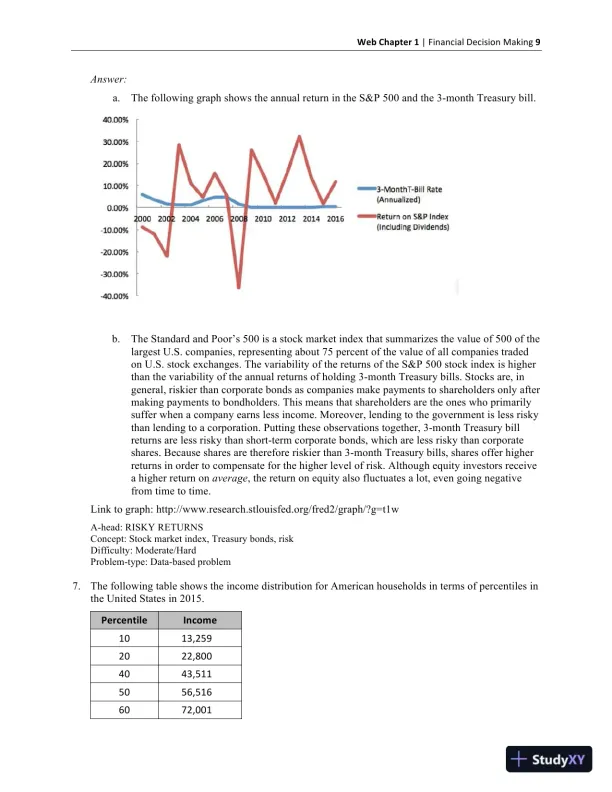

Page 9

Loading page image...

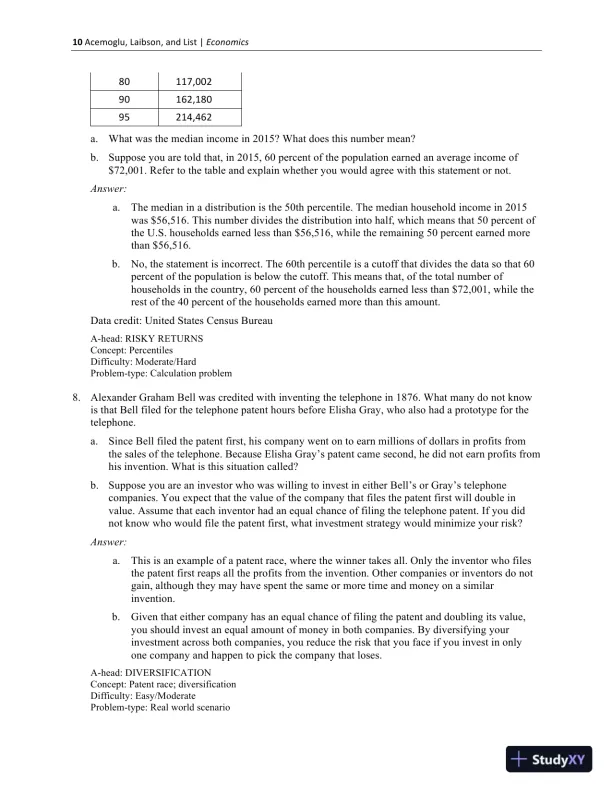

Page 10

Loading page image...

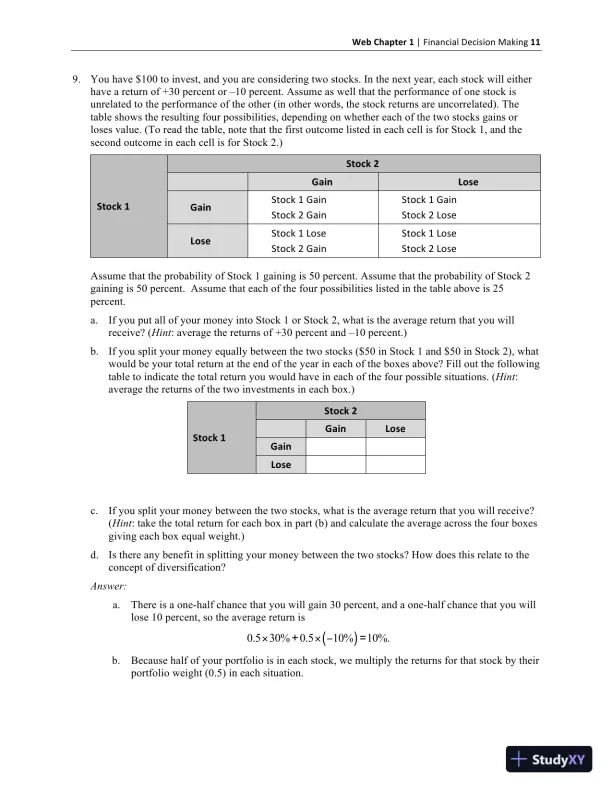

Page 11

Loading page image...

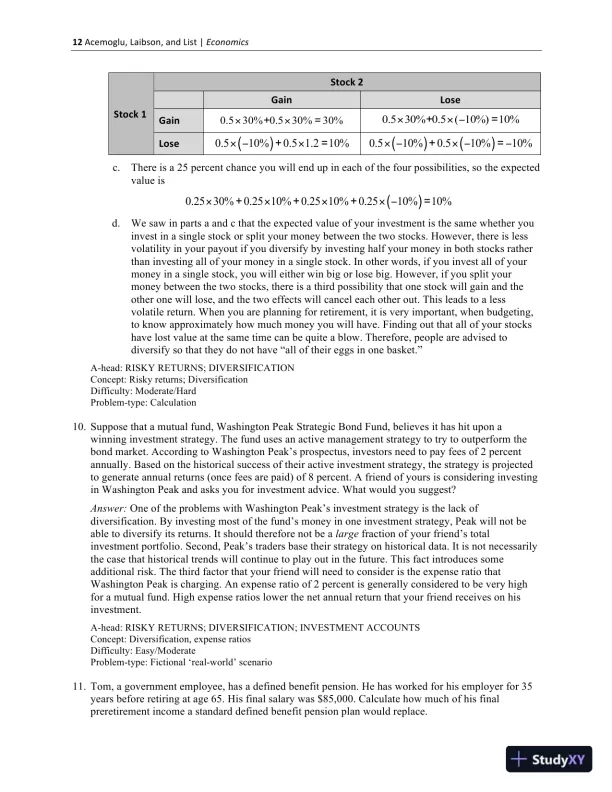

Page 12

Loading page image...

Page 13

Loading page image...