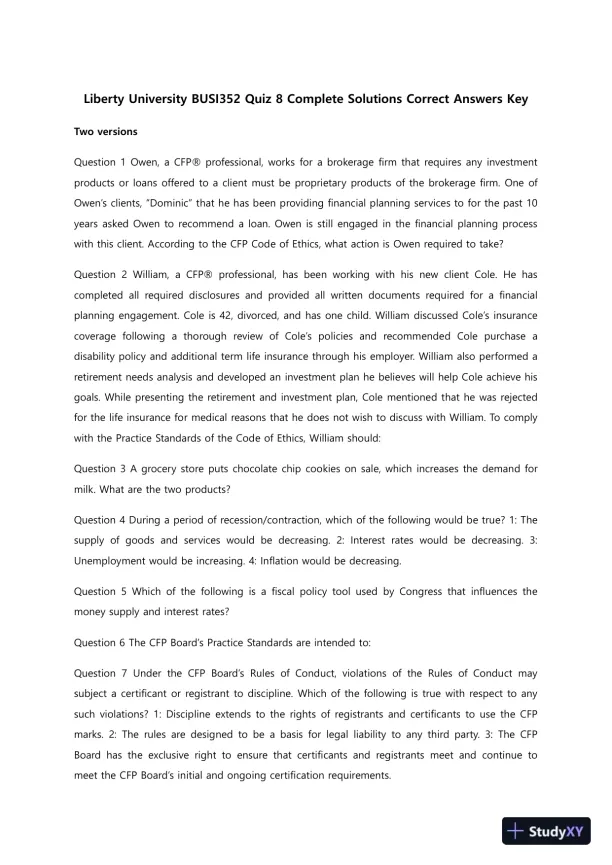

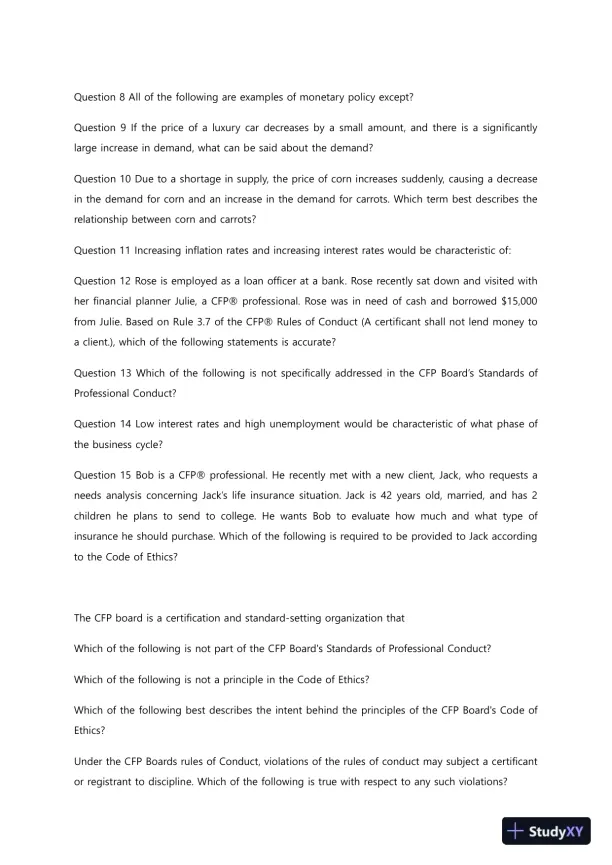

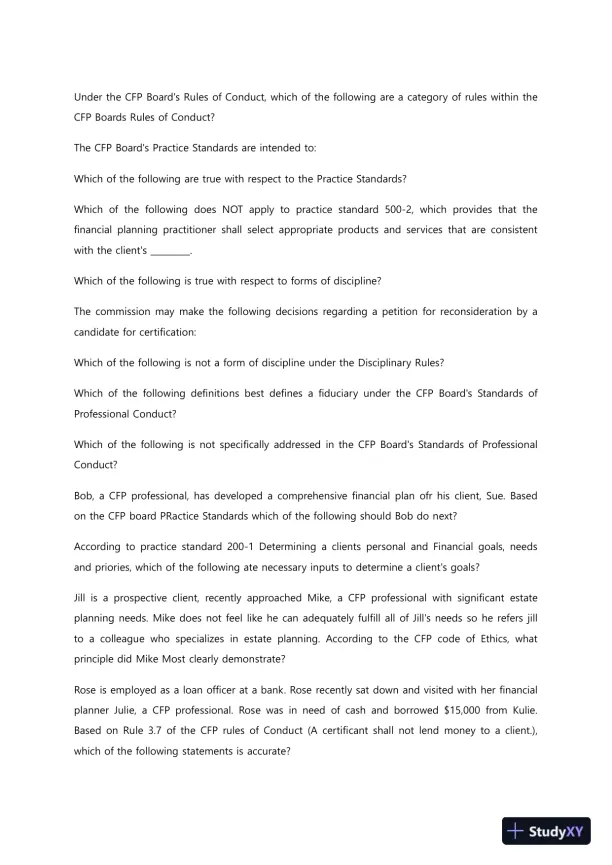

Page 1

Loading page image...

Page 2

Loading page image...

Page 3

Loading page image...

Page 4

Loading page image...

A fully solved answer key for Quiz 8 in BUSI352 at Liberty University.

Loading page image...

Loading page image...

Loading page image...

Loading page image...

This document has 10 pages. Sign in to access the full document!