Page 1

Loading page ...

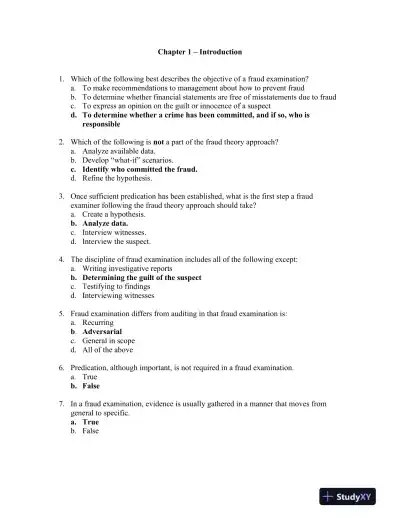

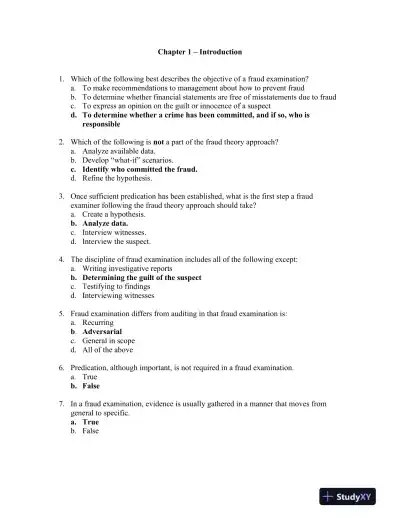

Prepare with confidence using Principles of Fraud Examination 4th Edition Test Bank, covering essential concepts, sample questions, and expert insights.

Loading page ...

This document has 94 pages. Sign in to access the full document!