Page 1

Loading page ...

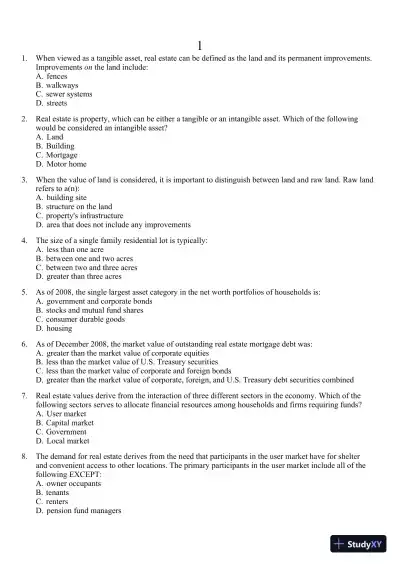

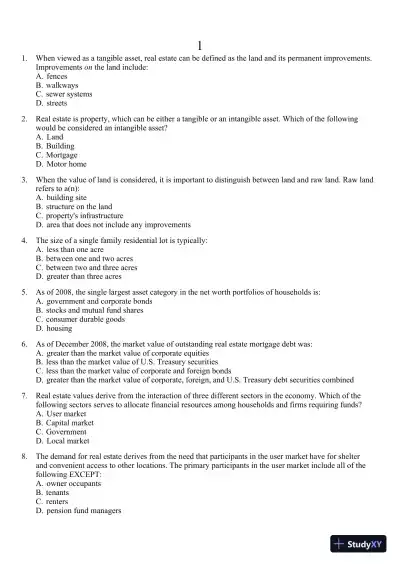

Real Estate Principles: A Value Approach (The Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate) 3rd Edition Test Bank delivers a complete question bank to help you study smarter and score higher.

Loading page ...

This document has 209 pages. Sign in to access the full document!